Superannuation will be a major investment for your retirement. The problem is that most people don’t pay attention to their Superannuation Fund. There are very simple strategies you can use to “Boost your Super”.

Investment Returns will make a BIG difference

The great thing about your Employer’s Contributions which can be supplemented with your additional contributions is that you don’t have to worry about the day-to-day management of your fund. However, your Superannuation Fund will encourage you to be involved by selecting the type of Asset Allocation for your fund. The Superannuation Fund will usually use terms such as Conservative, Moderate, Balanced, Growth and High Growth to describe how your fund is invested.

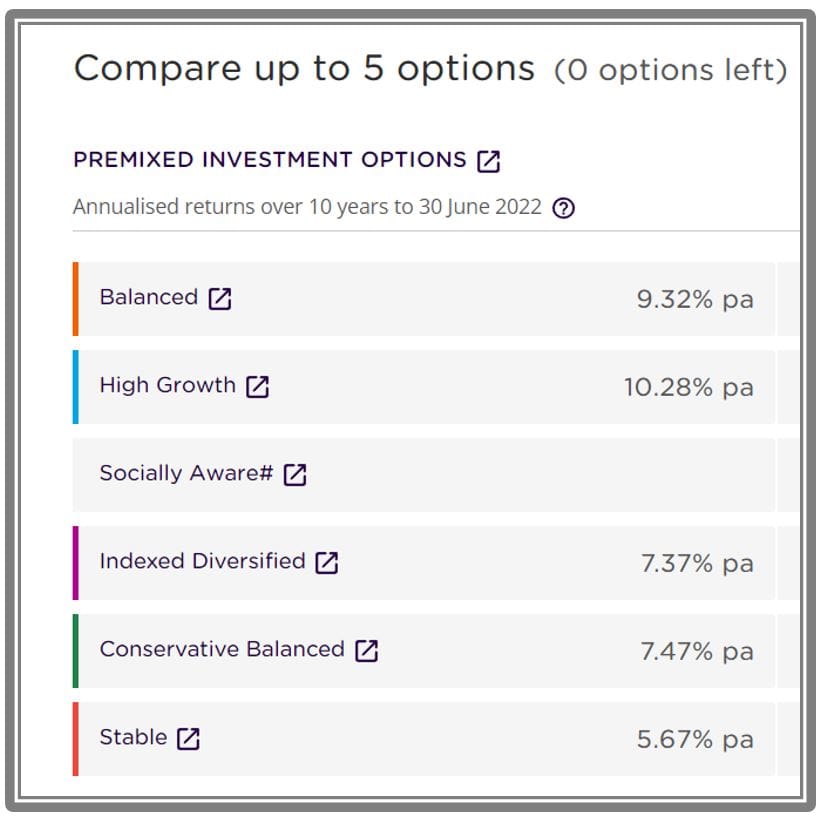

Each Superannuation Fund will provide their members with historical data to help them decide what is the choice of investment options. As an example, I have created a table of the information provided by Australian Super for their members. This information is based on their performance over the past 10 years.

Modern theory of investing suggests that while you are younger and have more time, they can select options that are likely to give higher returns. As higher returns are often associated with higher risk, it is usual to reduce that risk as one moves into the retirement phase.

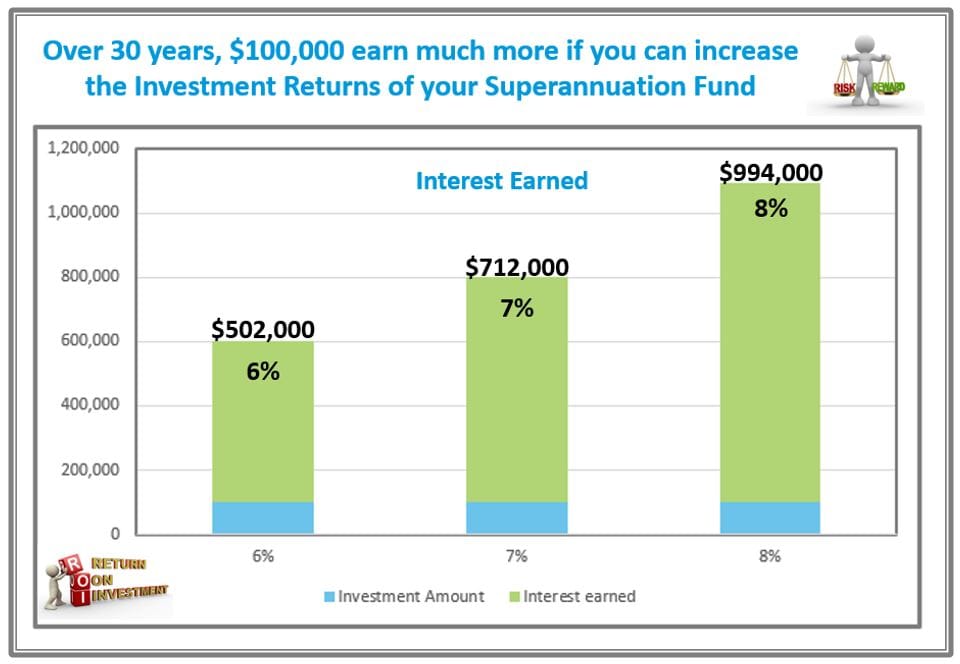

The difference in the outcome of $100,000 invested over 30 years can be significant where one is able to comfortably increase the returns. This graph compares how an Investment Return of 6%, 7%, and 8%.

The difference between a 2% return over 30 years is likely to be $502,000 with a 6% Investment Return to $994,000 with an Investment Return of 8%. That is almost double the result by simply selecting an asset allocation providing a higher, but safe return for your age.

Don’t assume the default option is the best choice for you.

It is so important to increase your Investment Returns if the risk is not too great. Your Superannuation Fund has qualified advisers who can assist in your decision-making process, or you may seek assistance from your Financial Adviser.

A Historical View of Superannuation Returns

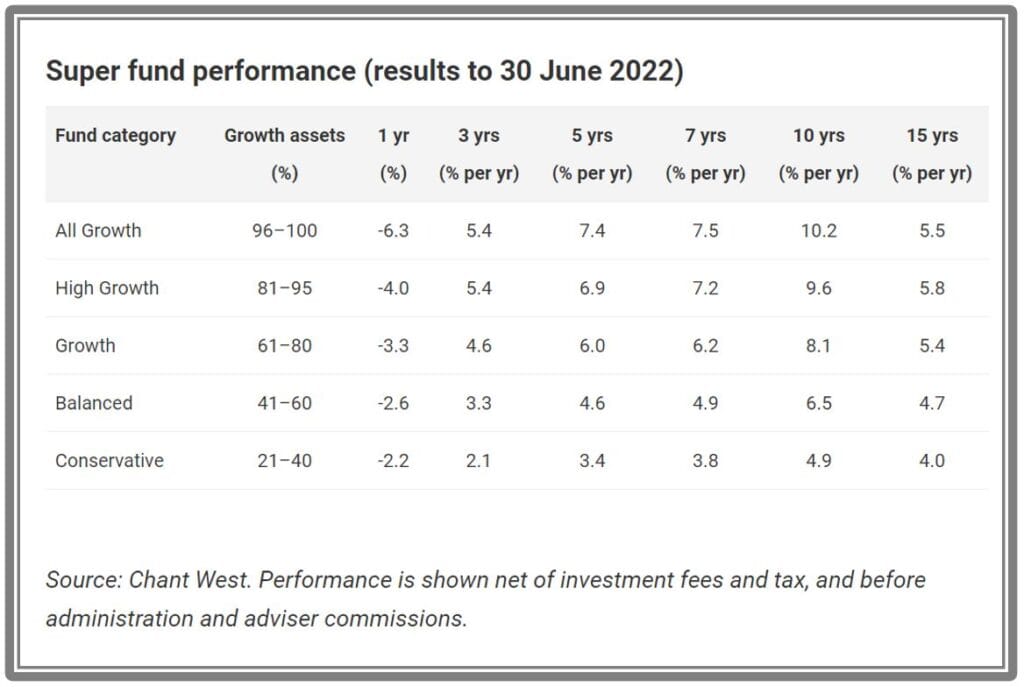

While the above table of Superannuation Investment Returns looks very positive over the last 10 years, extending the time frame to 15-years shows a significant difference in returns over the last 10 years and 15 years. This information is provided by Super Guide. If you are projecting your long-term Superannuation Account balances, using Investment Returns that match the time period is a good idea. However, we need to be mindful that past performance is not always a good indicator of future performance.

If you extend the historical investment returns to 30 years, the general opinion is that the return will be 7%. The return is of quoted as an Real (After Inflation) Return of between 3.5% and 4.5% depending on the asset allocation of the fund.

Consolidate your Superannuation Funds

Management Fees can affect your account balance significantly. Consolidating multiple Superannuation Funds is the first thing you should do. If you contact your primary fund, they will assist you in the process.

The next thing to consider is whether or not your Superannuation Fund’s management fees are low compared to similar types of funds. However, before you decide to change funds, you should seek professional advice, as there may be high exit fees.

Make Additional Superannuation Contributions

You can choose to make both after-tax and pre-tax personal contributions. However, you should remember that generally, you can’t access this money until you retire. The other risk is a legislative risk as you can’t predict any future government changes to Superannuation.

From July 2022 your employer’s Superannuation Guarantee Levy (SGL) rose to 10.5%. The rate will continue to rise until it reaches 12% in about 3-years. For younger people this increase will make a significant difference to their final balance.

While you may be paying a little more tax on investments outside Superannuation, there are tax strategies that can reduce the tax rate.

The choice is quite complex and is something you should discuss with someone licensed and qualified to advise. This is likely to be your accountant or financial adviser if you have one.

ASIC MoneySmart Resources

MoneySmart is always the first reference point I recommend my readers consult. Here you will get simple unbiased advice.

These are the two pages you should consult for Superannuation

Take advice from Australia’s leading experts on Personal Finance

While Noel Whittaker is well past retirement age, he continues to care for the financial well-being of all Australians. Good Financial Reads has reviewed his 4-book collection called A Bundle of Wisdom.

Go to the Noel Whittaker website to find a fantastic selection of books. For those wanting to increase their knowledge about Superannuation and Retirement, you may want to read Retirement Made Simple and Superannuation Made Simple.

For a more general approach to wealth management, I would also recommend Scott Pape’s books The Barefoot Investor or Barefoot Investor for Families, which have been reviewed by Good Financial Reads.

While attending to your personal needs for Superannuation, Scott Pape gives an important piece of advice for parents of teenagers. This is what he has to say:

By starting at age 15, when every child should get their first part-time job, they will be hundreds of thousands of dollars better off financially than their peers. Having a 10-year jumpstart on their peers is the key. With the Barefoot Investor’s help, you can ensure your child has $500,000 more in their Superannuation Account when they retire. You simply must get your child to take 15-minutes to set up their Superannuation Account correctly. The good thing is that they can have this extra money, without contributing one extra cent. They just need to see their superannuation is invested in the best account for them.

Financial Mappers and Superannuation

Financial Planning Software for Superannuation

If you choose to manage your investments, Financial Mappers offers you the opportunity to make long-term plans. Many investors choose to have both a financial adviser and use Financial Mappers so they can better understand the choices recommended by their adviser. The software provides a substantial Financial Literacy Program and Tutorials.

Superannuation Accounts are integrated into your plan. The account will:

- Monitor your account balances according to contribution type

- Change the Asset Allocation, Investment Returns, and Fees over different time periods

- Drawdown your Superannuation Fund using one of three methods

Watch this Video

Please share this article and video clip Boost your Super with friends.

Glenis Phillips SF Fin – Designer of Financial Mappers

Further Reading

Check out this other articles on Superannuation:

- 5 Tips for Managing your Super (Dr Tracey West of Griffith University)

- 7 Tips to better manage your Super (UniSuper)

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.