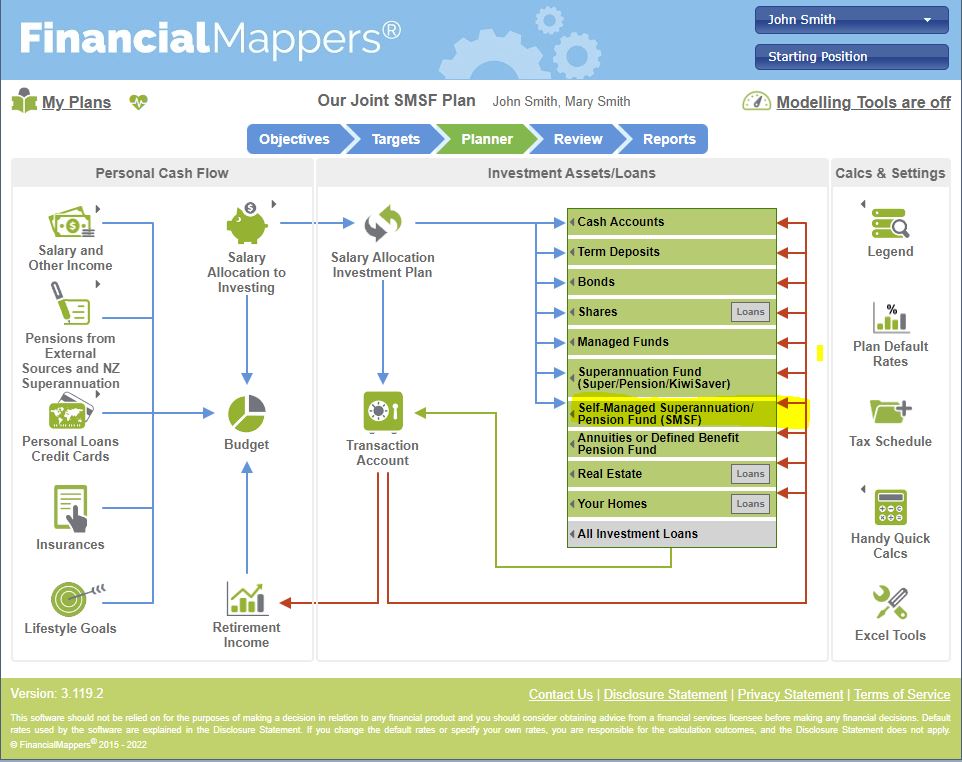

Do you want to know if your super is likely to sustain your lifestyle throughout your retirement? With Financial Mappers you can project your SMSF plan up to 50 years after you retire, giving you an indication of whether you’ll still be sitting comfortably. Of course the provision is that your predictions turn out to be correct. But with all the modelling tools you can work a range of ‘What if?’ scenarios to help make an informed analysis of your future financial prospects.

Read on to find out how generating SMSF reports, including your annual Strategy Document, will ease your mind when it comes to the crucial task of retiring planning and collating your hard-earned money. In addition to creating reports, you can download all the graphs in your SMSF plan to write your Investment Plan.

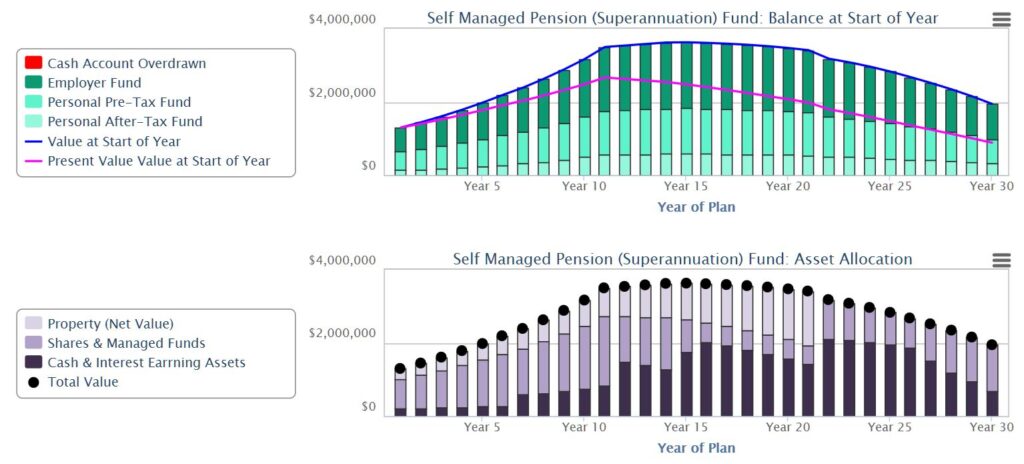

Look at this graph to see how your SMSF can be divided into three types of accounts – cash (and other interest-earning accounts), combined shares and managed funds and one account for each investment property and loan. This is powerful software – no more relying on one average return for the whole fund.

Voluntary contributions

Find out how making additional personal contributions to your SMSF could dramatically change the quality of living that you will enjoy in your retirement.

You can view these projections in easy to read graphs. When you see those savings bars standing at a level height, even into your 70s, you’ll feel much more secure about the future.

Earning interest

The key to successful investing for retirement is to start as early as possible, so that you enjoy the effect of compound interest. Albert Einstein once said, ‘Compound interest is the eighth wonder of the world. He who understands it earns it, he who doesn’t pays it’.

See how investing smartly now, can be the difference between a holiday to see your distant cousins in Broken Hill, and a month-long cruise around the Caribbean in twenty years. After all, you want your retirement to be a celebration; a chance to do all of the things you haven’t had time for since you were twenty!

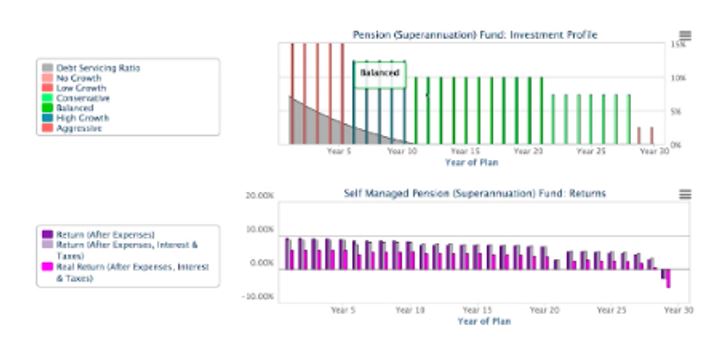

Assessing risks

The graphs in Financial Mappers may give you a better insight into your investment profile. The percentage of interest-earning assets is used as a basis to calculate your Investment Profile. For example, if you have less than 20% of your assets in interest-earning assets, your investment profile is described as Aggressive. Modern theories of risk profile, suggest that the older one is, the less risk one can afford to take.

Another means of reviewing your risk profile is the return on your investments. It is generally accepted that the higher the investment return, the greater the risk the investment may fail. For example, if someone is offering to pay you an interest rate of 15% when banks are only offering 5%, then the risk of first investment is much higher than the second. On the other hand, if you have all your assets in low-returning investments, particularly those without any potential for capital growth, your ability to grow your wealth is also diminished. One needs to find a balance between the two extremes.

The graphs in Financial Mappers give you an instant picture of these risks over the life of your plan.

Investment Properties

If you own investment properties in your SMSF, you will be depending on the income generated through renting for much of your retirement. So you want to make sure the figures are sound. Each of your properties will generate its own graph to assist you in figuring out when is the best time to buy or sell. A common failure of SMSF trustees is to consider when the property will need to be sold. Because the percentage of compulsory drawdown increases as you age, there will come a time, when the rental income cannot meet this minimum drawdown and the property will need to be sold.

Ready to get started planning your fabulous retirement? Download Financial Mappers’ superior financial planning software and rest assured that you’ll be enjoying your later years in comfort.

Watch Video

Watch this short video.

Are you using a Financial Advisor or Accountant? Ask them if they’re using Financial Mappers PRO to enjoy the benefits of Financial Mappers with their professional advice!

If you manage your SMSF independently why not use Financial Mappers to manage your SMSF cash flows that are all integrated into your total financial plan?

Glenis Phillips SF FIN – Designer of Financial Mappers

Further Reading

Check out these articles I have found for you:

- Your self-managed superannuation fund (SMSF) investment strategy (ATO)

- SMSF Invest Strategy (SW Superannuation Warehouse)

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.