I think it is a pity that Credit Card Debt is often the first introduction to debt. It is a bit like giving a child free reign in a lolly shop where they can eat as much as they like without any parental control. They may continue to gorge themselves with lollies until they make themselves sick.

Likewise with Credit Card Debt, there are few constraints on who can have a card, the limit of their credit and how they repay the debt. Thus, the young consumer may see their Credit Card as a means of having immediate access to anything they want without consideration as to how the debt will be repaid. The major consequence is that they may have so much personal debt to repay, the interest costs limit the ability to create real wealth through savings or borrowing to create wealth.

Ideally Credit Cards should be paid in full by the due date but unfortunately circumstances beyond your control may prevent you from doing this on rare occasions.

Alternative to Credit Card – Debit Card

With so many online purchases it is almost impossible to manage without a Credit Card. The alternative is a Debit Card. The difference is that you must save the money you want to spend first and then deposit it in your Debit Card Account. Once you have spent the money in your account you cannot purchase more items until you save enough money to make a new deposit to your card.

The Debit Card controls how much you can spend and should stop impulse purchases.

Emergency Credit Card

One advantage of having a Credit Card is that you can quickly access funds in the case of an emergency such as illness or an expense such as a large car repair bill.

Although you will be paying high interest costs, your access is immediate. I would recommend that you keep such a card for true emergencies and for buying things you can afford to repay at the end of each month.

Credit Card Fees

Most Credit Cards will have an Annual Fee. This fee can range from $0 to $400, but you should expect a fee of about $150. The amount of the fee will depend on the additional features, with the fee being higher when more fees are offered.

Basic cards often have no fees, while those with features like Rewards Programs are much higher. If you want to have a Rewards Program, make sure the additional cost will compensate you with rewards you want.

There are websites that allow you to compare costs but be careful because some of these sites may be intended to show a particular card in a good light and not display cards that may have better features.

These are three Credit Card Comparison Sites:

Minimum Repayments

All cards offer a monthly minimum balance which may be a percentage or a dollar value. If you only pay the minimum balance, you will never repay the debt. Eventually, the balance will grow to your credit limit and then you must commence paying down the balance.

Creating a Budget to pay down your Credit Card Debt.

In recent years, the government has changed the rules to the limits of debt on the card. Usually. the amount should be payable by the consumer within three years. The limit will vary depending on the salary and other debt commitments.

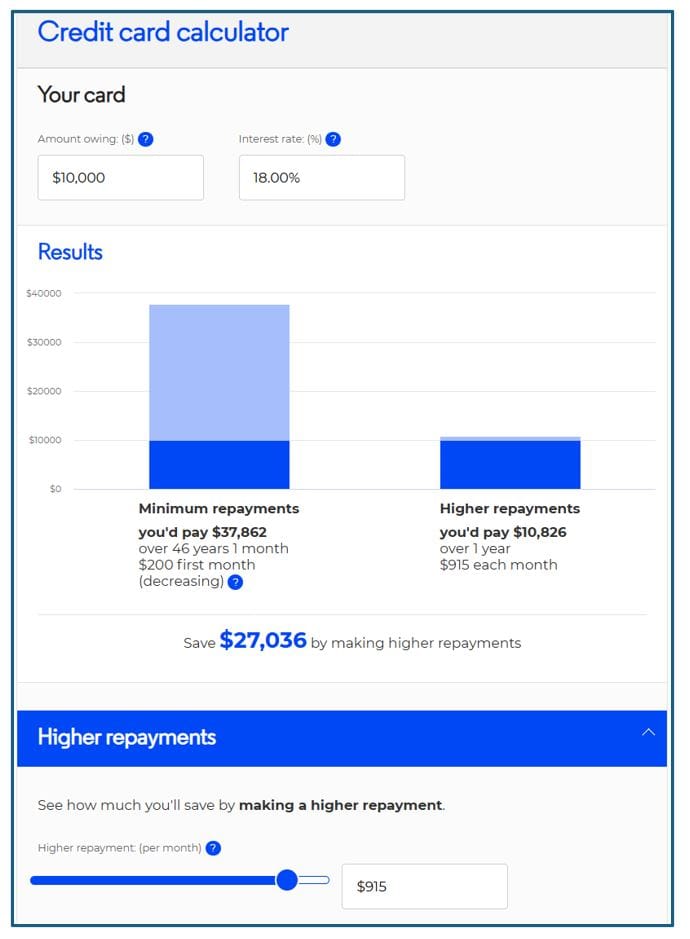

Money Smart (Government sponsored) gives valuable unbiased advice regarding the use of Credit Cards. The website includes a Calculator where you can determine the effect of paying more than the balance. In this example, note how much interest is saved by repaying the debt of $10,000 over one year.

Subscribe to Financial Mappers Blogs

Please register on the Financial Mappers Blog Page to receive notification when new articles are uploaded.

You will also be notified when our new software Financial Mappers Free is available. This will enable you to make a 5 Year Financial Plan, free of charge.

If you have friends or family who you think would love to have this free resource, please share this article.

To find out more, please watch this short video Credit Card Debt.

Financial Mappers FREE

With Financial Mappers FREE is now available. Click here to join.

Glenis Phillips SF Fin – Developer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.