Credit Scores can be a looking glass into the type of person who wants to borrow money. In America, Credit Scores have become entrenched in their way of life so that even an employer won’t consider a potential employee unless they have a high Credit Score.

Lenders consider a person with a high Credit Score to be more likely to meet the requirements of their loan. Lenders most interested in Credit Scores are those who offer loans, credit cards and some financial products.

It is important that you protect your Credit Score which can be undermined if someone gains access to your personal details and commits Identity Fraud. Companies that create Credit Scores also provide monitoring of your Identity. These services come at a cost and for some, may be worth considering as an extra layer of security.

Who provides Credit Scores

In America, the most common Credit Score is called FICO, developed by Fair Isaac Corporation.

In Australia, the most important providers of Credit Scores are Equifax, Eperian and Illiion. Their role is to collect and assess information about people who borrow money. From the information they can calculate a Credit Score. There are others, and you simply need to do a Google search for Credit Scores to find more.

You can engage these companies to monitor your Credit Score and ensure that your name and personal details are not being used to gain loans or stead your identity.

Equifax provides a Credit Score and Identity Protection. You can request a Credit Report. This will enable you to ensure the information they are holding is correct and if unauthorised persons have accessed your personal information. They offer a range of paid services, as do all Credit Score agencies.

How to Protect your Credit Score

You should develop healthy loan management skills. This includes paying all your accounts on time. Paying your bills late will reduce your Credit Score. If you can’t repay all your credit card balance at the end of the month, you should pay more than the minimum and set about reducing that balance as quickly as possible.

Credit Score agency will also monitor the behaviour of borrowers. It may be that frequently taking out loans, will reduce your Credit Score. Maintain an Emergency Fund, that you may use if for any reason you can’t pay your loan payment on time. Keep your credit card limits low.

Educate yourself by reading a variety of books relating to debt management. Good Financial Reads has reviewed the book Pay Off your Mortgage in 10 Years by Serina Bird and Smart Money, Smart Kids by Dave Ramsey.

Dave Ramsay is an iconic TV host in America who hates debt and says the only loan should have is a home loan which can be repaid in 15 years. This may be a bit extreme for most, but it does deliver a message. One of my favourite quotes from Dave Ramsay is:

Don’t buy things you can’t afford with money you don’t have to impress people you don’t like.

Credit Scores are usually a score out of 1,000. Credit Scores above 750 are considered good and those about 853 are considered excellent. Check your Credit Score now and if you do not have a good or excellent Credit Score, consider ways you can increase your Credit Score.

MoneySmart

The ASIC’s MoneySmart website has excellent information about https://moneysmart.gov.au/managing-debt/credit-scores-and-credit-reports .

The topics include:

- Get your Credit Score and Report for free

- Credit Score

- How is your Credit Score calculated

- What’s in a Credit Report

- Fix mistakes in your Credit Report

If you are concerned you may be a victim of Identity theft, you should consult their webpage on Identity Theft.

Subscribe to Financial Mappers Blogs

Please register on the Financial Mappers Blog Page to receive notification when new articles are uploaded.

If you have friends or family who you think would love to have this free resource, please share this article.

To find out more, please watch this short video Credit Scores.

If you are serious about maintaining a high Credit Score, read these articles on the Financial Mappers website:

- The Advantages of Paying Down Debt with Financial Planning

- The Dangers of Living on Borrowed Money Explained

Financial Mappers FREE

With Financial Mappers FREE is now available. Click here to join.

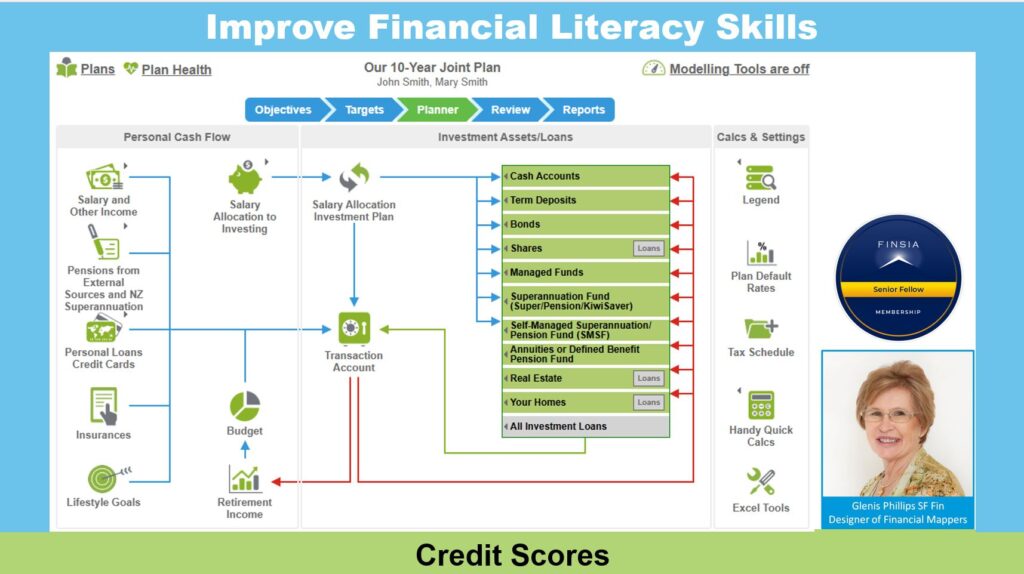

Glenis Phillips SF Fin – Developer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.