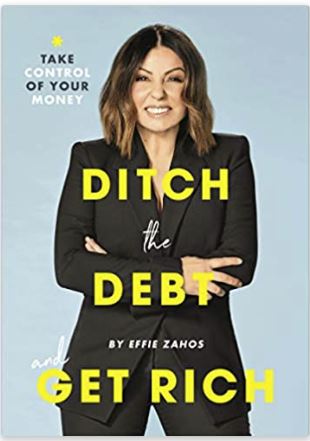

Glenis Phillips, author of Good Financial Reads has reviewed “Ditch the Debt and Get Rich” by Effie Zahos. This is a “MUST READ” book for anyone who has credit card and personal debts.

As I was standing in a supermarket queue, the title of this book “Ditch the Debt and Get Rich” caught my eye, and I could not resist the impulse buy. I am so pleased I did because I think the information in this book is the best, I have seen for some years for those wanting to take control of their money and get rich.

The author, Effie Zahos is one of Australia’s leading personal finance commentators and has held several prestigious positions. Currently, she is the Editor-at-Large of Canstar. She sits on the board of the Ecstra Foundation, a not-for-profit organization promoting financial wellbeing. She is also the author of A Real Girl’s Guide to Money and The Great $20 Adventure (for children).

Ditch the Debt and Get Rich may mislead people into thinking that the book is primarily about debt. In reality, the subtitle Take Control of your Money, is a much more accurate description of this book. Effie has assembled a team of several experts who have allowed her to discuss in detail not only the management of debt but all aspects of one’s personal finances. Written in 2020, this book is very up to date and answers some of the hard questions all investors have faced since the start of the COVID pandemic. This information is backed up with some great statistics.

Ditch the Debt and Get Rich takes the reader on a journey giving them the answers to so many questions. These are questions which everyone will face during their lifetime. These are questions such as how I manage my debts, how to I pay for life milestones such as buying a car, and practical information on how to invest.

This book would also be an excellent gift for your children who need to set in place good financial practices at the start of their working live. It could make the difference between a constant financial struggle and feeling comfortable with their money and working towards a long-term plan of financial stability and wealth. The information will stop them falling into bad debt traps early in life. There is a very valuable guide for young people who only have small sums of money to invest, but want to start now.

The book is divided into five parts each of which has addressed the issues that most people face in dedicated chapters. The five parts are:

- Master your money mindset

- Get that monkey off your back

- Tick off those life milestones

- Think rich, be rich

- What you have always wanted to know

As a long-term serious investor and author of “Good Financial Reads”, my knowledge is very extensive when it comes to finance. Even with this experience, the information in the book made me stop and reflect on the management of my personal investments.

This is a book for everyone. It doesn’t matter if:

- You are bogged down with personal debt

- You want to start an investment program

- You are an experienced investor and want to rethink your current strategies.

I highly recommend this book for everyone.

I am the designer of Financial Mappers, financial planning software designed to allow the DIYI investor to plan like a professional. While Financial Mappers, is used by financial advisers, you can use the software independently. This book will give you many strategies for both debt reduction and wealth creation. All these strategies can be tested using Financial Mappers.

Glenis Phillips SF Fin – Good Financial Reads

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.