Diversification is an important tool in risk management. Generally different asset types will rise and fall in value at different times and will be related to demand for the asset. For example, if the consumer feels there is an increased risk of war, resulting in falling share prices, they may move more of their assets to gold. Shares that invest in gold are likely to rise faster than those that do not. For this reason, you should diversify your assets so that each asset class will compliment the others as prices rise and fall. In addition, each asset class will have provided different levels of income.

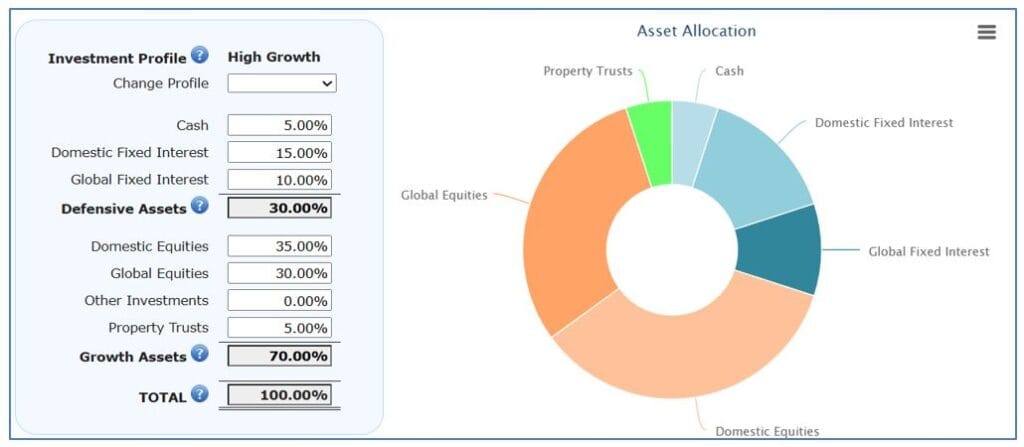

For most people, Superannuation is their largest investment. If your Superannuation is managed by a third party, you should check to see how they diversify their assets. Generally, they will provide members with a pie graph showing the diversification. This Asset Allocation is showing 30% in Defensive Assets and the remainder in Growth Assets.

The general philosophy has been to increase the percentage of Defensive Assets as one gets older.

Australians seem to love real estate when investing for themselves. Real Estate will usually require considerable debt at the start of the purchase. Real Estate is a very “lumpy” asset that will lower the level of diversification. For some, the option is to invest in Property Trusts rather than real property will help them diversify. This allows them to manage their asset allocation better. Another option could be to save for a portfolio of shares before embarking on the purchase of real estate. The home should be considered as part of your wealth.

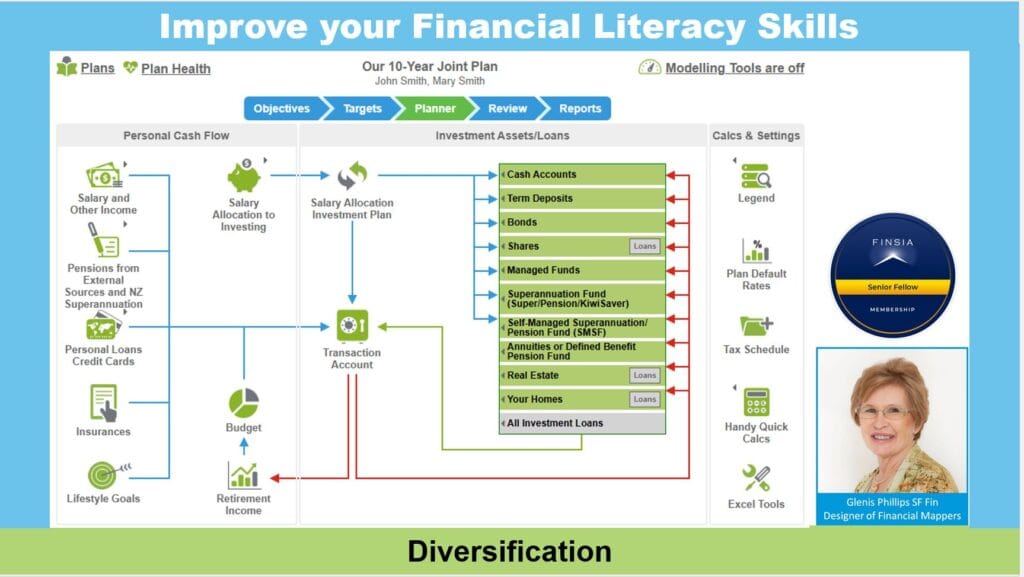

Create a Plan to Manage your Asset Diversification

Understanding the importance of diversification, you should develop a financial plan that take into consideration the best way to diversify your assets.

For the consumer, assets are generally divided into Defensive and Growth Assets.

Defensive Assets are generally more stable and designed to protect capital. However this comes with lower income. Defensive assets can include:

- Cash, including savings accounts and cash management accounts

- Fixed Interest Investments such as Bonds (government or corporate and other fixed-income securities

- Gold that are considered a safe haven when there is economic uncertainty

Growth assets are expected to increase in value and may also offer higher levels of income. Growth Assets are considered to be of higher risk than Defensive Assets. They are more suitable for long term investors. While Real Estate is a growth asset, it is often considered a defensive asset. Growth Assets can include:

- Real Estate

- Equities

- Managed Fund that has a combination of cash, equities and real estate

Money Smart offers sound information about Diversification. Topics include:

- How diversification benefits you

- How to diversify

- Identify gaps and research other asset classes

- Keep your investments diversified by rebalancing your portfolio

Subscribe to Financial Mappers Blogs

Please register on the Financial Mappers Blog Page to receive notification when new articles are uploaded.

If you have friends or family who you think would love to have this free resource, please share this article.

To find out more, please watch this short video Diversification.

When you diversify your assets, you reduce your investment risk. If you would like to know more about reducing risk, consider reading these articles on the Financial Mappers Blog pages:

- Understanding Interest Rate Risk in Investment Decisions

- Smart Investments Strategies for Retirement Income Planning

Financial Mappers FREE

With Financial Mappers FREE is now available. Click here to join.

Glenis Phillips SF Fin – Developer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.