The thought of long-term falling share market prices is likely to raise your Fear and Greed Index. How will you manage a fall in your share values?

Both the share market and bond markets in the USA may well be at a major inflection point. But this uncertain. The minor shakeout in the markets in early February completely unnerved investors. Many thought we may be at the start of falling share market prices.

Warren Buffett’s Advice on falling share markets

Warren Buffett is the originator of many famous quotes. Everyone knows:

When the tide goes out you see who is swimming naked

Another of his better known is:

Don’t invest in anything you don’t understand

With the recent fall in share market prices, the talking heads were again reassuring the public. They were saying that all is well with the economy in the USA and the rest of the world. Some were saying that you should ease up on your share portfolio, some saying buy more shares, or buy more bonds. You sometimes wonder about this advice. Is the advice offered something to do with what they are either selling or betting against. A common investor strategy is to have an investment portfolio in both shares and bonds. You would then expect to increase the exposure to bonds for more safety.

Another strategy is to use alternative investments. These have been are the basis of the gains and returns obtained by many investment funds in the last few years. Do you understand the nuances and fine print of any of them. They all sound infallible.

What’s an Investor to do in a falling share market?

Michael Lebowitz of Real Investment Advice has some alternative strategies. He gives investors a choice not dependent on rising stock and bonds values. These include:

- Global Macro

- Deep Value

- Option Strategy

- Event Driven

- Arbitrage

- Volatility

- Long/Short

- Trend Following

- Fund of Funds

These are investment methods popularised by money managers over recent years. An Inverse VIX ETF has been popular with investors. Over the last year they had been making steady profits. But they were completely wiped out in two days. In early February, the share market wobbled a bit with 1,000 point swings in the Dow Jones Index. The share price of this popular investment vehicle went from $140 per share to $4 overnight. Many similar “investment vehicles” crashed with falling share prices.

The professionals have other methods using larger speculative positions. Many believe they are completely safe, and even profitable if a market turns downward.

It is almost impossible to understand these investments. Often they are computer automated. Who do you follow? Warren Buffett or a salesman promoting a new algorithm. These algorithms are often untested in down markets. What could go wrong? Will you suffer serious losses? This has been the case for many investors in every serious market downturn.

Understanding Market Volatility for your Share Portfolio with Financial Mappers.

Anticipated returns for 10 years

Few people understand the implications of major long-term down trends. Nor do they understand how long it may take for their shares to recover.

With Financial Mappers, we have developed a series of economic trends from historical data which allows you to see the effect on your share portfolio. To demonstrate, I have created a financial plan where the investor has a share portfolio of $100,000.

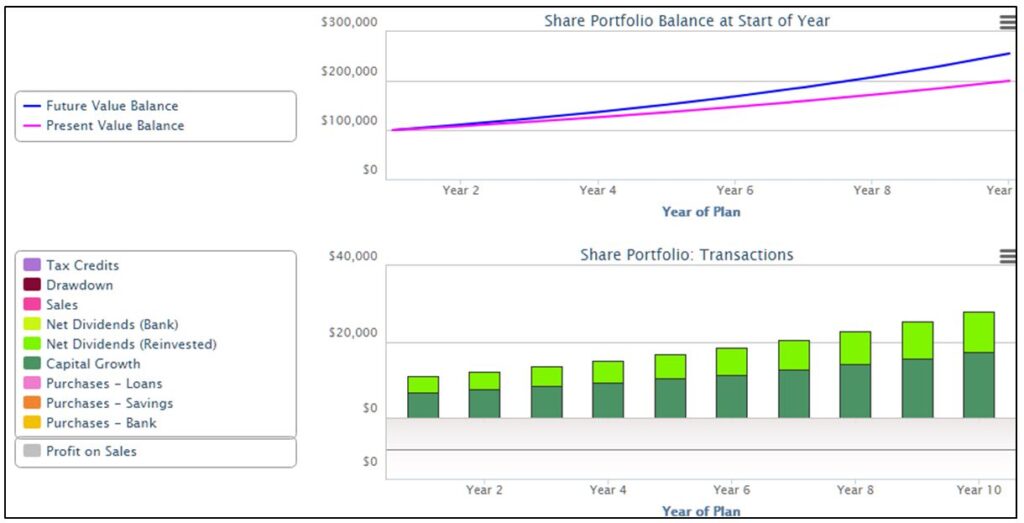

This is a graph of the anticipated change in the value of the portfolio, together with the estimated dividends and capital growth. The returns are based on a capital growth of 6.75% and dividends of 4.5% which are reinvested. This is a total return of 11% per annum. Tax implications have not been considered.

It is estimated the value of the portfolio will rise to $283,399 over the next ten years.

Economic Cycle of Falling Prices

Long term predictions of share price movement use long term average returns. But returns on investments will vary on a yearly basis. Financial Mappers allows you to use these variations in returns. This gives a better understanding of share price valuations.

It gives you the opportunity to consider the effect of falling share prices.

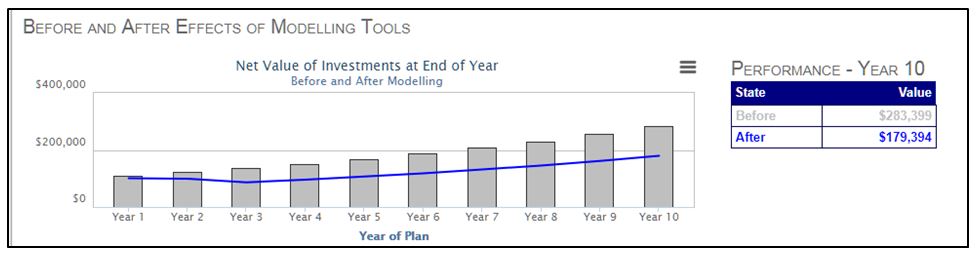

Financial Mappers has a set of small economic cycles for shares and real estate. This economic cycle has a 40% fall in share market prices over three years.

For this exercise, there is a 3-year period of falling share prices. The returns for the next seven years are long term average rates. Note how the value of the portfolio underperforms expectations for the remaining 7-years. The final value is almost $100,000 less than the predicted long term returns.

How long will it take to recover from a 30% fall in share prices?

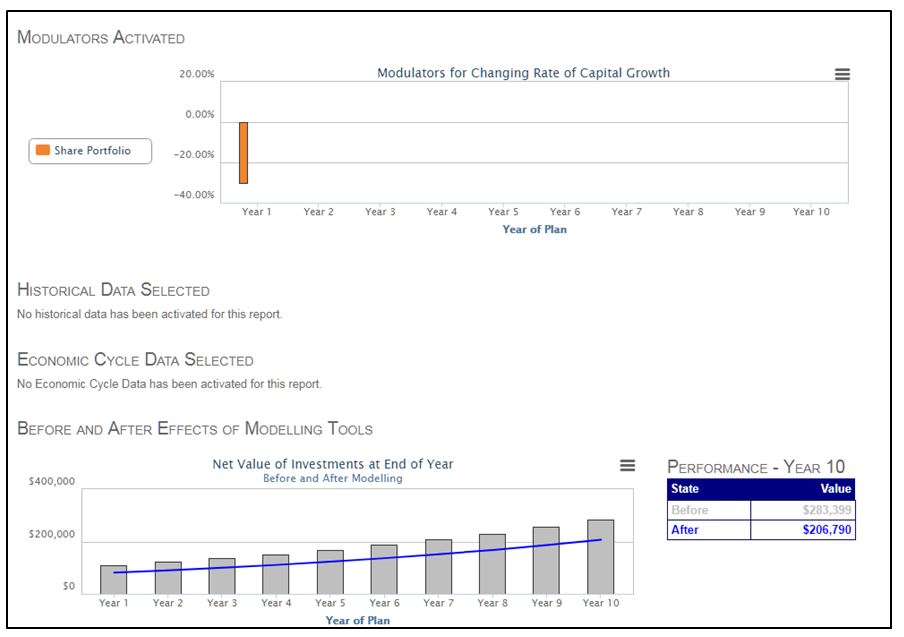

The wonderful thing about Financial Mappers is that you can you can model any What If scenario. In this case, I have explored the likely outcome of a 30% fall in share prices this year. The share market prices then return to its average long-term rate.

Again the share price never recovers to the anticipated prices of long term averages.

What are the typical returns over a 10-year period?

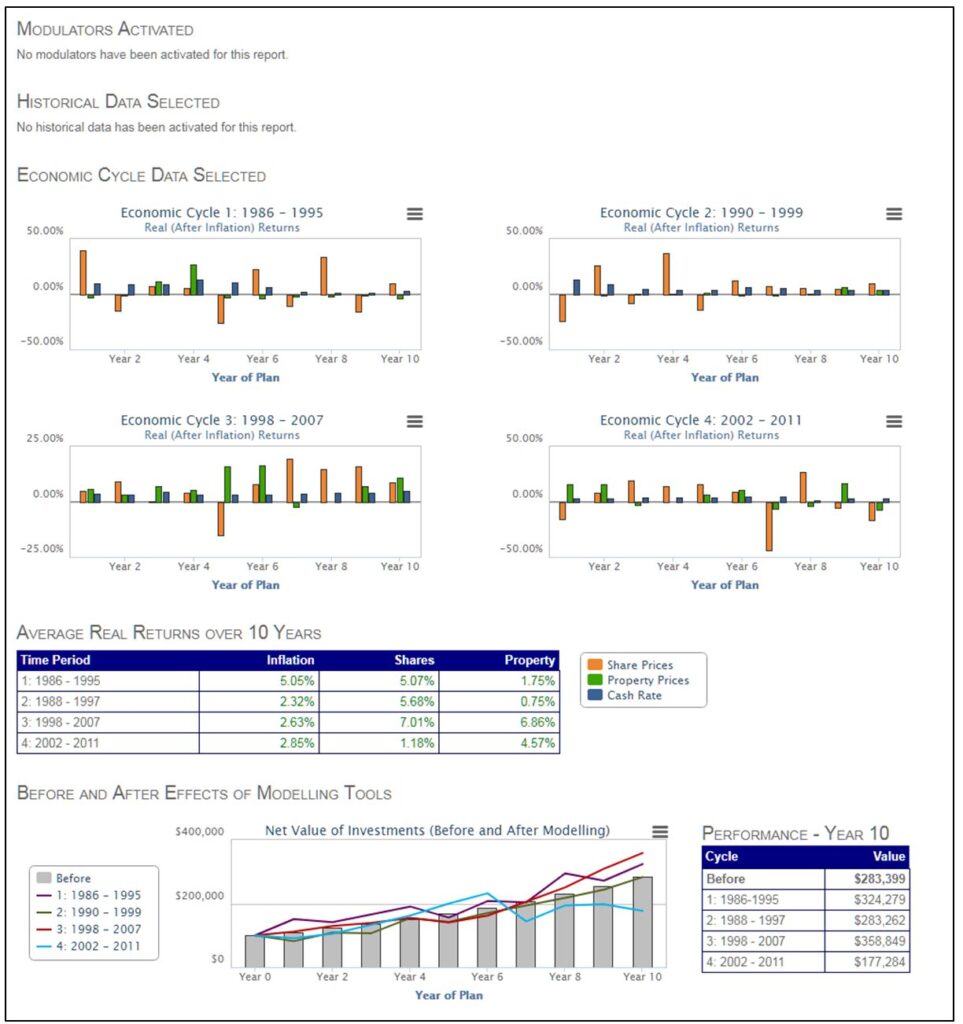

Financial Mappers has created a set of four 10-year economic cycles. These span the period between the period of 1986 and 2011. In two cycles either shares or real estate will outperform the other. On the third cycle they perform about the same and during the last cycle, they both perform poorly.

This enables you to consider four possible outcomes simultaneously. These are the anticipated results of the share portfolio..

In two cycles ,you will outperform your anticipated long term average. One cycle performs quite badly.

Evaluating the effect of adverse events on your whole Financial Plan

Financial Planning Software with Modelling Tools

In the above examples, the Share Portfolio is a standalone plan with one asset. But, in real life, investors will most likely have a range of investments. This is likely to include a significant part of Superannuation. You will also have to consider the effect of taxation. Also, you will be adding more savings as well as buying and selling assets.

Financial Mappers allows you to take into consideration your total future plans. What If scenarios give you alternative results. It will also allow you to make a joint plan. You and your partner can make a plan with assets held in one name or jointly.

Like all financial planning software, Financial Mappers, cannot predict the future. But, you can consider likely outcomes for you if a particular set of economic events occur.

This will allow you to construct a portfolio which tries to protect you with a diversified set of assets. You can then test your plan. A Modelling Tools Report demonstrates the Before and After Effect.

Want to learn more about investing with Financial Mappers?

Watch Video

Glenis Phillips SF FIN – Designer of Financial Mappers

Further Reading

Check out these articles I have found for you:

- Warren Buffett’s investing philosophy in 8 steps (The Motley Fool)

- What causes share prices to change (Personal IG)

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.