With worldwide economic disruption, now, more than ever, financial advisers need new technologies and business models to assist and retain clients and attract new clients. As an adviser, you probably feel uneasy that your client base requirements are changing and your long-standing practices may not keep your clients engaged or be willing to pay your fees.

With worldwide economic disruption, now, more than ever, financial advisers need new technologies and business models to assist and retain clients and attract new clients. As an adviser, you probably feel uneasy that your client base requirements are changing and your long-standing practices may not keep your clients engaged or be willing to pay your fees.

As a financial adviser, have you thought about how much value you add to your client’s financial well-being? Have you wondered how you may quantify and demonstrate the value you add?

- What if a new technology were available for you to easily quantify and demonstrate the value you have added to your client’s wealth and goals?

- What if you could provide your advice in an easy-to-understand digital format?

- Wouldn’t it be even better to have your client feel involved in the planning process?

- What if one single innovative software could deliver all this and more to maintain and set your practice up for the future?

Some advisers tell me they struggle to find time to learn new software, while all their spare time is spent in preparation for FASEA exams and meeting increased regulatory demands. Perhaps you are concerned that there may be difficulty in the integration of new software into your existing practice?

Is now the right time for you to look at introducing changes without practice disruption?

I invite you to look at three innovative features of Financial Mappers, allowing you to engage with clients and demonstrate your value.

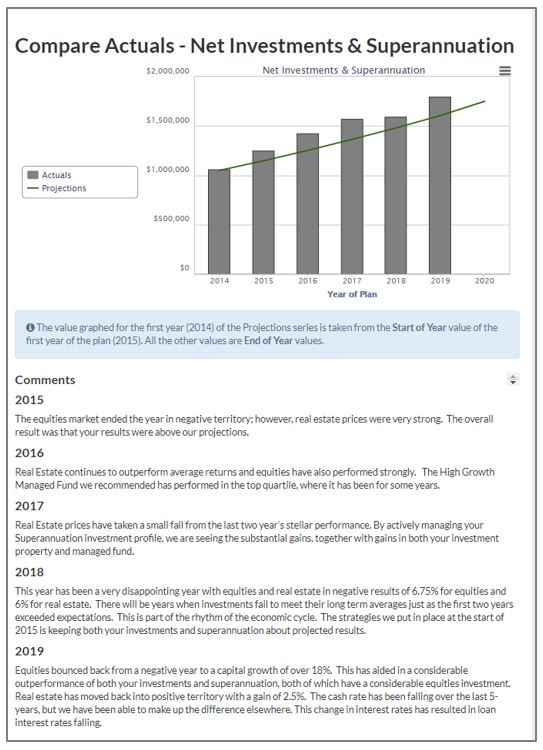

Our first feature is the Wealth Tracker Performance Review

This powerful tool allows an adviser to demonstrate the value they add and record the actual results their clients achieved each year. You can also include comments specific to that year.

For more detailed information on how to personalize the Wealth Tracker Performance Review, visit our website – E-REVIEW (Interactive Reports).

Our second feature is the Client Review Gateway

The magic of the Client Review Gateway is the ability to share the portal with the client after the meeting, so they can, at their leisure, review and understand the advice given at the meeting.

Advisers are all aware that many clients do not engage with the traditional Statement of Advice, designed by lawyers to cover every possible loophole.

Financial Mappers has been part of an FPA initiative to devise digital reports and deliver these in an understandable multimedia format.

At client meetings, the adviser can upload any of the customized reports they have designed into the Client Review Gateway. They can take the client through the report, one section at a time, with the explanations written on one side of the screen and graphs on the other. Supplementary documents can be added together with educational content.

Later at home, if the client has any additional questions, these can be asked in the Q&A section, with the adviser responding directly. Together with the timing feature, a complete record of the client’s engagement with the report is maintained.

Watch Video

To find out more, visit the website E-REVIEW page, where you can also watch this short video.

Our third and most innovative feature is the selective sharing of plans with the client

All research indicates that the modern client wants to be involved in the planning process.

Financial Mappers was designed for ease of use, thus both advisers and clients can use the software and shared planning ability, at the adviser’s discretion.

After the adviser has explained their recommendations at a meeting, the adviser can choose to share either the first 5-years or the full plan with the client.

The client makes a copy of the shared plan where they can generate reports, use the modelling tools to experiment with “What If? scenarios and modify the plan. For example, the client may want to see the effect of say, saving more, or making personal contributions to superannuation.

This sharing of the software feature has a second and enormously powerful function. It allows the adviser to service low-net-worth clients, orphaned clients, and their future full-service clients, the millennials. These clients can create their partial plans and then reach out for scaled or full-service advice when required.

If a Financial Adviser chooses to use the Connect Client feature, this link to the Client Review Gateway, Reports, and Financial Plans can be shared using encrypted transference of data – No More Emails.

Register for our Demonstration Video

To find out more register for our Demonstration Video (Financial Professionals Page) and ask for access to our Financial Mappers Pro Resources and a software trial.

Glenis Phillips SF Fin Designer of Financial Mappers

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.