During the month of April 2020, Aleks Vickovich, Wealth Editor of the Financial Review, highlighted three separate threats to Financial Advisers. However, there are new digital tools that can protect Financial Advisers from these threats.

According to Investment Trends, 48% of the Australian population have unmet financial advice needs. Increasingly complex government regulation imposed on financial advisers is likely to show an even higher percentage of unmet needs as cost of servicing clients rise.

This increased cost will see those who most need the services of an adviser will be excluded.

Companies on the periphery of the financial advice industry have seen opportunities to service this market by finding ways to circumvent the higher compliance standards required of financial advisers.

The likely outcome is that these other service providers will grow their client base, become more profitable and offer more services, so that in time, client needs have been serviced elsewhere long before the client thinks “I need financial advice”.

Unless financial advisers recognise this threat now and take immediate action, they may find their industry is irrelevant for all but the very wealthy with complex investment strategies.

The Financial Review

According to Aleks Vickovich of the Financial Review there are three threats to financial advisers from other sources servicing their clients more cost effectively.

These articles are:

- How the virus inspired the F45 of Financial Advice (09.04.2020)

- Inside H&R Block’s plan to bring Financial Advice to the masses (17.04.2020)

- Amid the virus, have robo-advisers found their moment? (30.04.2020)

Financial Coaching

Financial Planner, Adele Martin, started My Money Buddy, for people who could not afford full service financial advice. Rather than providing financial advice, she has decided the best way to get people on track is to coach them on how to manage their budgets and start saving for the future.

Adele has shown that people are very receptive to this form of improving basic financial literacy skills. However, she had chosen not to give financial advice because of the compliance cost.

At Financial Mappers we believe that financial advisers can extend this type of educational program to providing scaled advice over shorter time periods for much lower fees than they currently charge.

H&R Block brings financial advice to the masses

The average income of an H&R Block client is $70,000. High fees exclude people in this income bracket from access to financial advisers.

H&R Block have been working with a Fintech, Fiduciary Financial Services, to provide some limited financial advice for fees of up to $300.

The types of services provided are:

- Home loans and other financial needs

- Superannuation

- Savings Planning

- Insurance and Risk Management

- Retirement Planning

- Aged Care

- Estate Planning

These are all bread and butter topics for the local financial adviser. Because H&R Block have a much lower fee structure, due the digital management of their clients, they will form long-term relationships with their clients. It is highly likely that once they can get a foot hold in the financial advice space, they will increase their services, while maintaining fees at a level the average person can afford.

There is no reason why financial advisers can’t provide similar services for similar fees, if they choose to service the mass market using digital tools provided by Fintech’s like Financial Mappers.

Robo-advisers can give investors simple low-cost solutions.

ASIC, in its Report 627, What Consumers Really Think, found that only 1% of participants had used digital advice, which is also known as robo-advice. However, the following was found:

- 19% of all participants said they were open to it (once it was explained to them)

- 37% of participants who had recently thought about getting financial advice but had not gone ahead were open to using digital advice.

It is likely that use of robo-advisers will rise for people who are just starting on their investment journey because is a low-cost, and it is a simple way to get into the market without requiring a high level of understanding or a lot of investment capital.

They simply need to decide how much each month or so they will invest and which investment type. For example, should they invest in an EFT which reflects the assets held in the ASX100 or ASX200.

Recently some robo-advisers have seen an unmet need in the robo-advice market. Companies such as Six Park, have introduced the concept of having a high-powered investment committee to help guide their clients choose the best products.

Vanguard and Fidelity have been in the robo-advice market for some time and charge zero investment fees. One recently introduced a $300 annual subscription fee for answering simple questions.

The Human Face of a Financial Adviser

Financial Advisers can be a much better “Human Face” to guide people towards investment choices if they are able to gather the client’s financial information more efficiently.

By choosing digital tools such as Financial Mappers Pro, advisers can now enter this market.

Advisers should consider whether there is advantage in having a group of clients preparing to start their financial journey. For some clients, this will mean taking them through a process over some years:

- Paying off personal debt

- Saving for a home deposit

- Assisting with the selection of the right home loan

- Start a regular savings strategy recommending cost efficient products

- Ensure they have adequate insurance using software which will assess their cash flows should they have an adverse event in the next few years.

Once the client is ready to make more complex investment strategies, the adviser will have a good relationship with that client. This is likely to be a life-time relationship provided the adviser is prepared to nurture new clients and get them to a position where they have acquired sound money management skills and have learned the long term value of investing for their future financial security.

Will Financial Advisers choose to change their service offering?

Aleks Vickovich of the Financial Review has outlined three threats to the income of financial advisers. However, each of these potential threats can be defused very simply if the adviser makes the right decisions now.

The adviser needs to engage with all people looking to improve their current financial situation.

Traditionally Financial Advisers have serviced the 15% – 20% of the market who have enough funds under management to warrant the fees of a financial adviser.

The problem for advisers, is that their clients are becoming more tech-savvy and more likely to look at other options.

The overwhelming body of research on client needs is that they do not want to be DIY Investors, but on the other hand they don’t want it all done for them without any input. So now we are seeing a rapid rise in the number of clients who want to be part of the planning process.

The type of complex financial planning tools used by most financial advisers, prevents any co-planning in the same space.

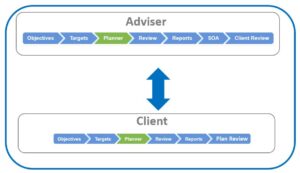

That was until the development of Financial Mappers Pro and the Lite Connect Client.

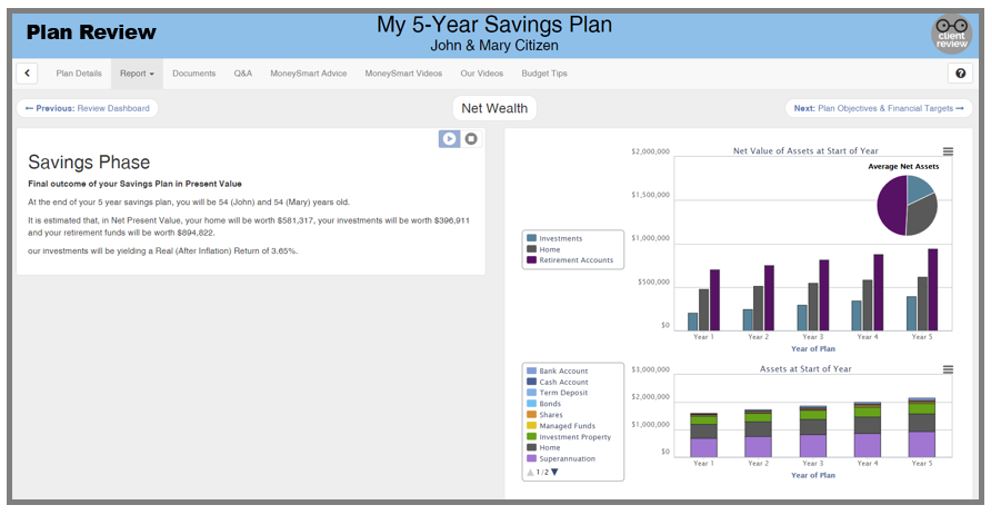

Financial Mappers offers a product called Financial Mappers LITE for members of the financial services industry who see a role in providing their clients with digital tools which enable their clients to make a simple 5-Year Savings Plan, where reports from that plan can be shared with the institution when the client seeks assistance.

Financial Mappers Pro caters to the provision of financial advice by an adviser and is a much more sophisticated offering.

The adviser can offer these new clients starting their financial journey, access to a 5-year plan, where the plan, unlike Financial Mappers Lite, can be shared with the adviser.

In the client’s view of the software, the Client Review is replaced with a Plan Review, where the client is also provided with educational content.

The client can then share this 5-year plan with the adviser and ask for specific, also know as scaled advice, on one question:

How can I increase my savings and earn more from my investments?

Should I pay off my home loan before I start saving for children’s school fees?

Do I have the right loan for my situation?

Should I be taking advantage of the Spouse Contribution or Government Co-Contribution for my partner who qualifies?

Am I better to have a balanced or high growth Managed Fund?

What happens if I want to make my current home an investment property and purchase a new home

Using Financial Mappers Pro, the adviser can quickly answer these and many more questions, within the software, using the SoA capability to meet the ASIC requirements when giving advice.

The adviser can increase the length of the plan and demonstrate, a longer-term outcome, should the client continue their current investment strategy. This information can be shared through the Client Review link.

Financial Advice to the Mass Market

Last year, I was invited to speak at the Adviser Innovation Summit 2019 on the Changing Face of Financial Advice.

Find out what I said:

Glenis Phillips SF FIN – Designer of Financial Mappers

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.