When a debt is identified as “Good Debt”, it generally indicates that the debt is being used to grow your wealth and have a revenue stream. Examples of “Good Debt” would be buying hard assets such as real estate or equities.

The definition of “Bad Debt” can be different depending on the purpose .

If a business funds sales by providing credit, that loan is considered a “Bad Debt” when the lender has identified the person as being unable to repay the debt 30 days after the loan is due to be repaid. This would include hard assets, where the borrower has not been able to meet loan payments.

If a consumer uses debt to fund a purchase where the item is losing or has no value, together with no revenue stream that debt is considered “Bad Debt”. In this case, examples of “Bad Debt” would be credit card debt, car loans and loans to fund holidays or personal items such as a television. While you may be meeting your loan payments, the debt is still categorized as “Bad Debt” because it is not growing your wealth.

Savings Vs Loans

The are some people who want to save for all their purchases. However, there are times when it may be better to borrow for the item and generate an income from it. For example, if you want to purchase an investment property, saving a deposit of say 10% to 20%, and borrowing the balance allows you to start generating income (after loan costs) sooner and from a smaller capital base.

Another example may be a car. While the car is depreciating in value and not generating an income, a car may be an essential mode of transportation for your employment. In this case, it is important to buy a car that you can afford based on your ability to repay the loan. This may be the time when you can create a savings plan for your next car, so that when the time comes you will be able to purchase the car outright.

Setting an example to our children

Children absorb so much from their parents. If you want you children to develop good attitudes towards debt, then you should set clear boundaries about how you fund your purchases. If your child wants an item you can’t afford, you could convey that message but also suggest that both you and the child start a savings plan to purchase the item later.

How can Good Debt become Bad Debt

There can be unforeseen circumstances where you may not be able to service your loan payments. In this situation your debt may move from the “Good Debt” to “Bad Debt” category.

One example may be that you unexpectedly find yourself unemployed and unable to service your loans. It is generally accepted that one should have an Emergency Fund that will pay for your living expenses, including loans, for three to six months. The time would depend on the security of your employment. If you don’t have an Emergency Fund, this is an issue you should address with the highest priority. If you find yourself in this situation, you could contact your lender and as soon as possible and see if they can help you through this short time of uncertainty. You don’t want to ruin you credit rating if possible.

If you loan has a variable interest rate, rising interest rates will increase the loan payments. It is important to ensure that you can afford these higher loan payments if this should occur. In the short term, you may be able to fix the interest rate, but this is usually only for the short term. A rule of thumb, which the banks may also use is to allow a 2% – 3% increase when calculating the affordability of the loan.

Relationships can break down and if you have joint loans, you may be responsible for your ex-partners debt unless you have carefully crafted the loan so that the ex-partner is still responsible.

Subscribe to Financial Mappers Blogs

Please register on the Financial Mappers Blog Page to receive notification when new articles are uploaded.

This will enable you to make a 5 Year Financial Plan, free of charge.

If you have friends or family who you think would love to have this free resource, please share this article.

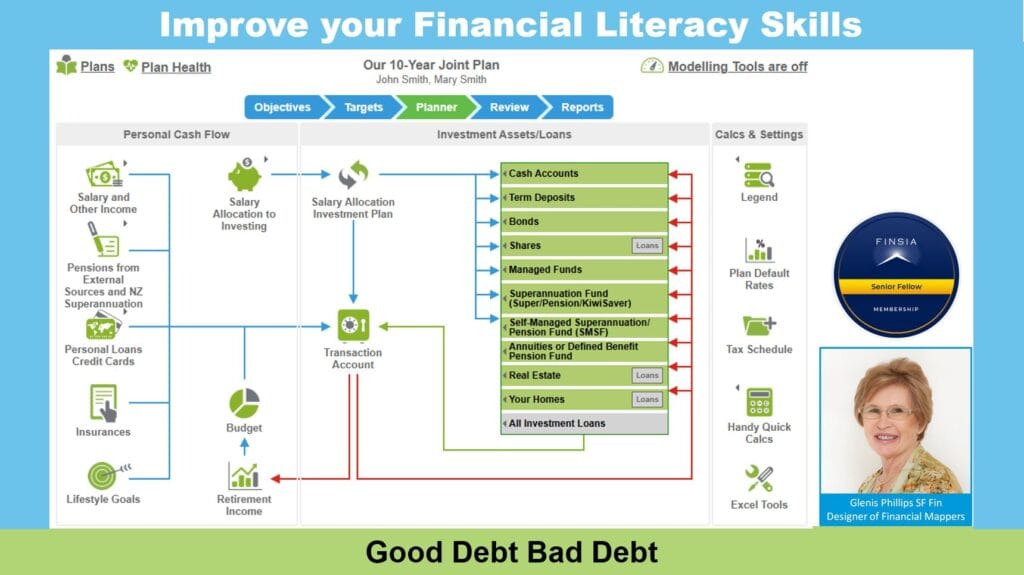

To find out more, please watch this short video Good Debt Bad Debt.

Financial Mappers FREE

With Financial Mappers FREE is now available. Click here to join.

Glenis Phillips SF Fin – Developer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.