On 20 April 2024, ABC News reported that HECS loans have ballooned in the past decade, leaving many workers caught in a ‘student debt spiral’. A debt spiral is where the balance of your debt is growing at a faster rate than you are repaying the debt.

Inflation Linked Debt

At the end of the year, the government determines the Inflation Rate from the previous year and increases the HECS debt by this amount. For many years, the Inflation Rate was kept within the Target Rate of 2% – 3%, with some years being less. This meant that the Inflation-linked increases were relatively small and generally covered by the HECS payments. However, in recent years, the inflation rate has been increasing, with it reaching 7.1% last year.

If you have a HECS Debt balance of $20,000 at the end of the financial year, the balance will increase to

- $20,200 with a 1% Inflation Rate

- $20,600 with a 3% Inflation Rate

- $21,000 with a 5% Inflation Rate

- $21,400 with a 7% Inflation Rate

When you receive your statement at the end of the year, check to ensure that your HECS Debt has been reduced from the previous year. If not consider making additional payments to catch up that extra loan amount. Rather than paying the regulated HECS fee, consider paying a minimum of the regulated fee PLUS the estimated Inflation Rate. This if your HECS is calculaled at 3% and Inflation is estimated to be 4%, then pay 7% of your Taxable Income to reduce the debt and match any Inflation-linked increase.

HECS Repayment Schedules for Year 2023-24

Each year, the government will publish a new list of Repayment Thresholds.

For the current financial year, the Repayment Thresholds are:

With an Inflation Rate of 7%, you would need an income of more than $112,986 to simply not increase your HECS Debt.

Recently the government has come under a barrage of complaints about the way the debt is linked to the Inflation Rate as the average worker can no longer afford to repay their debt unless they choose to make additional voluntary payments.

It is likely that the government may address this issue in the next Budget.

Post-script on Indexation 4 May 2024

On the 4 Mary, 2024, 9 News reporter Conor Duffy (National Education and Parenting reporter), announced that it is likely if passed by the government, the method of indexation will be changed. It is anticipated that the method will be the lower of either the Consumer Price Index or the Wage Price Index. This would mean that in the year commencing 1 June 1923, HECS Debt will increase by the WPI index of 2.3% instead of the CPI index of 7.1%.

This will be a big saving for all students.

The Bank of MUM and DAD

The Bank of Mum and Dad is a very old institution with more parents feeling obligated to help their children financially. It is not uncommon for parents to provide a substantial part of their children’s home deposit. They are also increasingly being expected to help with the private school fees of their grandchildren.

Before a parent embarks on providing financial support to their children, it is important that they can afford this support without limiting their own financial well-being, particularly in retirement.

I believe there is a lot of merit in parents having a sit-down with their child when they start part-time employment.

You need to explain whether you are in a financial position to help them with HECS fees, home deposits and even financial support through provision of board and keep while undergoing tertiary education.

Your child needs to understand that if HECS fees are not paid in part or in full while studying they are likely to graduate with a considerable debt. If you can help with these fees, then perhaps some rules should be applied to your gift so that the gift is appreciated. Things you may like to consider are:

- For every dollar your child saves to pay HECS while studying you will match it dollar for dollar.

- You will pay your child’s HECS fees if they achieve a nominated pass rate, say a Credit or above

If you can’t afford to support your child’s education fees, maybe suggest that your child works for a year before starting study and save for those HECS fees during that year.

It could be that a percentage of income from those part-time jobs at high school are put aside to help fund HECS fees when they start tertiary education.

How will HECS Debt affect buying a home

When assessing a home loan, the lender will assess all other debts and how much the borrower must pay. HECS debt will play an important role in reducing the amount the borrower can borrow for a home. One option is to consider paying HECS debt in full before embarking on a home loan.

As you can see from the Repayments Thresholds listed above, the percentage of income used to pay the HECS debt is relatively small until you get to over $150,000 in which case the percentage is 10%. When you create your Budget, you could allocate 10% of all income earned to paying down your HECS debt.

It is amazing how little you will miss the expenses that are automatically paid from your Salary.

It is important that before you take any action that relates to tax liability and HECS Debt, you speak with your accountant or financial adviser.

Financial Mappers

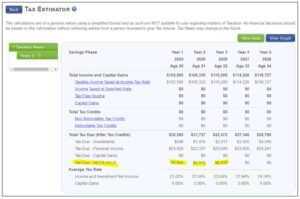

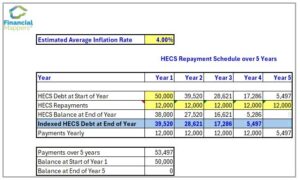

Financial Mappers will calculate the regulated HECS payments with the balance at the end of each year being increased by the nominated Inflation Rate in the plan. This is an example of a $20,000 debt being repaid over 3-years, where the balance is indexed at an Inflation Rate of 2.5% for the plan.

Using the Excel Tools, you can select the WB, HECS Repayment Calculator and calculate how quickly you can repay your debt by increasing the repayments from the regulated HECS payments.

Financial Mappers is cashflow modelling software that will help you plan your financial future, and does not provide financial advice in the process. If you require financial advice, you should consult a Financial Adviser licensed to provide financial advice.

Glenis Phillips SF Fin – Designer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.