These statistics underline the need for comprehensive financial education programs that can reach both genders and provide them with the necessary skills to navigate their financial landscapes confidently.

It was found that after age 65, financial knowledge decreases, with only about 40% of seniors being able to answer the questions correctly. This decline is concerning, especially as life expectancy increases, necessitating effective money management to avoid financial difficulties in later life.

To combat this, ongoing financial education should be prioritized for seniors, equipping them with tools to manage their finances effectively as they age.

The lack of financial literacy can lead to high levels of debt and poor financial decisions. For instance, understanding the differences between fixed and variable interest rates is crucial for making informed choices about loans and mortgages, impacting long-term financial health.

Moreover, inadequate knowledge can result in missing opportunities for savings and investments, which could enhance financial stability over time. It’s essential for individuals to educate themselves on these matters to prevent unnecessary financial burdens.

Financial education is crucial in today’s fast-paced world, influencing your capacity to generate wealth and plan for the future. Whether you’re just starting your career or nearing retirement, it’s never too late to enhance your financial knowledge.

Taking small steps towards financial education can have a profound impact, such as enrolling in workshops, reading financial literature, or even consulting with financial advisors. Each of these actions contributes to a brighter financial future.

Money-related issues are significant sources of stress for many individuals. Financial problems can lead to overwhelming negative emotions, self-doubt, and can even adversely affect one’s physical health.

Addressing financial literacy can help reduce this stress. When individuals understand their financial situation and feel empowered to make informed decisions, they experience less anxiety and greater control over their lives.

Understanding Compound Interest

The first and one of the most important concepts to understand is Compound Interest.

Compound interest is a fundamental concept in finance that can significantly affect your savings and investments. It refers to the process where the interest earned on an investment is reinvested to generate additional interest.

Compound interest is not just about interest on the principal amount; it encompasses the concept of earning interest on interest. This is crucial for investors aiming to grow their wealth over time.

Compound interest includes interest on the initial amount, but interest paid on future interest. Thus if your interest is paid at the end of the year, the interest would be less than if the interest were paid quarterly or monthly.

For example, if you invest $10,000 at a 5% interest rate compounded annually, after one year, you would earn $500 in interest. However, if you leave your money invested for another year, your new balance would be $10,500, and you would earn interest on this larger amount the following year.

Understanding how compounding works is essential for maximizing your investment returns over time. It encourages a long-term perspective on saving and investing.

In the following table, we illustrate the difference in returns on an investment of $100,000 over one year at a 10% interest rate, comparing various compounding frequencies.

As you can see, the frequency of compounding can dramatically influence the total returns. The more frequently the interest is compounded, the more you earn.

With annual compounding, you’ll earn $10,000 in interest. With semi-annual compounding, this amount increases to $10,250, and with quarterly compounding, it goes up to $10,409. If compounded monthly, the interest earned becomes $10,471. This illustrates the power of compound interest.

This example underscores why understanding compounding is essential for anyone serious about building wealth.

This leads to the concept of the Effective Rate of Return. While the nominal rate remains constant at 10%, the Effective Rate of Return increases based on the compounding frequency, showcasing the benefits of more frequent interest payments.

For investors, this means that when evaluating potential investments, it’s crucial to consider the effective rate of return alongside the nominal rate to make informed choices that maximize returns.

When comparing investment opportunities, always evaluate which option offers the highest effective rate of return. Investments with the same interest rate can yield different returns based on compounding frequency.

This emphasizes the importance of doing thorough research and calculations before making investment decisions, as the small differences can lead to significant financial outcomes over time.

Subscribe to Financial Mappers Blogs for Continuous Learning

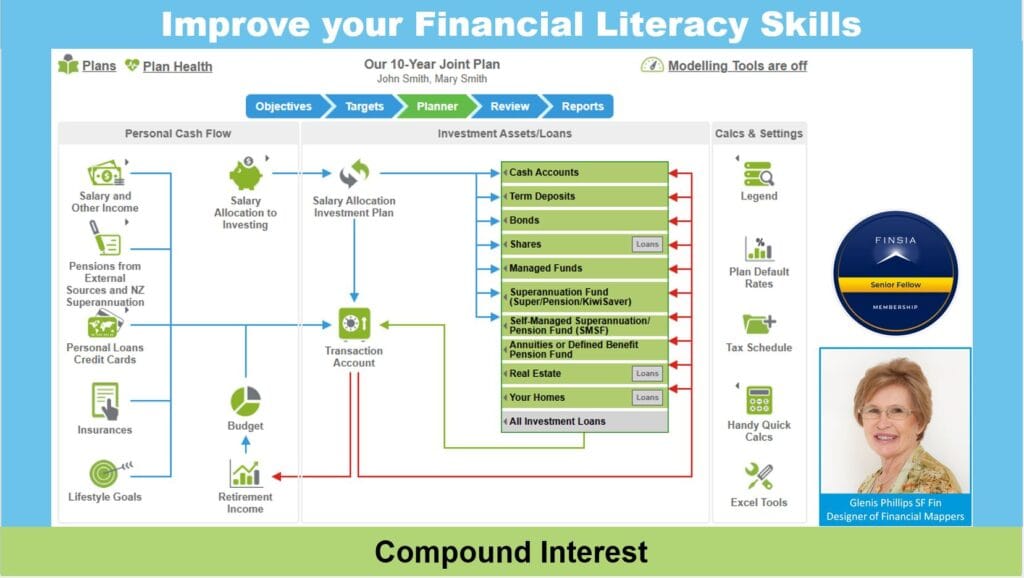

Over the coming weeks, I will present a series of articles aimed at enhancing your financial skills, providing insights and strategies that you can apply to your financial life. Please register on the Financial Mappers Blog Page to receive notifications when new articles are uploaded.

These articles will cover a range of topics, from personal budgeting techniques and investment strategies to tax planning and retirement savings, all designed to empower you with the knowledge needed to make better financial decisions.

If you have friends or family who you think would benefit from this free resource, please share this article with them. The more people are educated about financial matters, the stronger our communities can become.

As we work together to improve our financial literacy, we can create a culture of smart financial decisions that leads to a more stable economic future for everyone.

Finally, watch this 2-minute video, Compound Interest, which explains the importance of saving regularly over the long term. It emphasizes that beginning to save early can drastically reduce the amount needed later to achieve your retirement goals.

Regular contributions, no matter how small, can lead to significant growth over time due to the power of compounding, reinforcing the importance of starting early in your financial journey.

Glenis Phillips SF Fin – Designer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.