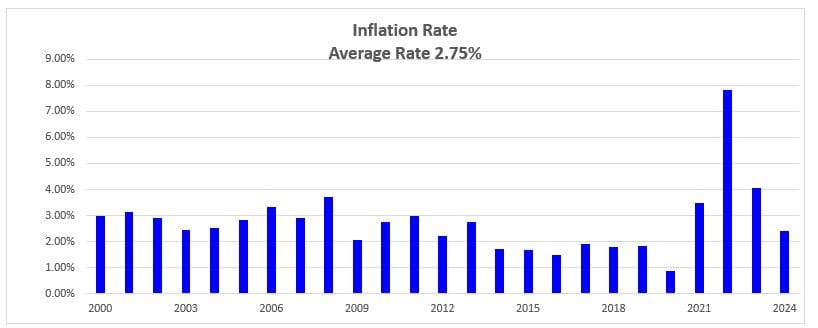

For the average person, Inflation is unlikely to be of concern until Inflation hits the headlines with dire warnings. Over the past 25 years the average inflation rate has been 2.75%. The Reserve Bank of Australia has a target Inflation Rate of between 2% and 3%.

Reviewing the graph of Inflation Rates over the last 25 years, there are only a few times when the Inflation Rate has risen above the higher end of the Inflation Target Rate.

The most notable exception was 2022. This has been attributed to strong demand after the pandemic recovery and supply disruptions due to the Ukraine War.

What does Inflation measure?

Inflation measures the change is prices. A common measure of Inflation is CPI which is the Consumer Price Index. This measure of Inflation measures the increase in price and services of items generally used by the consumer. It will include common food and beverages, housing transportation and health.

To give an example. Imagine your weekly shop at the supermarket is $100. If inflation is 2%, in the next year, then it will cost you $102 to purchase the same items. If Inflation is 10% then it will cos you $110 to purchase the same items. The problem occurs when your wages are not rising at the same rate as inflation. You will not have sufficient funds to cover the increased cost of your purchases.

There are other indexes that will measure other rates of growth. The most important ones are:

- Wage Price Index (WPI) measures the rate at which wages rise. If your wages are rising at a lower rate that the CPI, you will have less buying capacity.

- S&P/ASX 200 (XJO) is the index most commonly used to measure the rate of change in Shares (Equities).

- (Established) House Index (HPI measures the rate at which house prices rise.

If the index is outperforming the CPI, then you are making real gains. The video at the end of this article gives a detailed demonstration.

The relationship between Interest Rates and Inflation

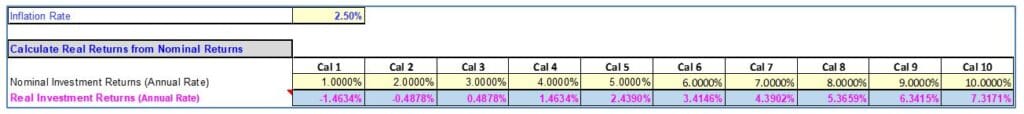

Interest Rates for both investors and borrowers are affected by Inflation. A general principle of the effect of Inflation is the Nominal Interest Rate less the Inflation Rate is the Real (After Inflation Rate). However, the formula to calculate the Real Interest Rates is more complex.

This graph calculates the Real Rate of Return for investments earning between 1% and 10% where the Inflation Rate is 2.5%

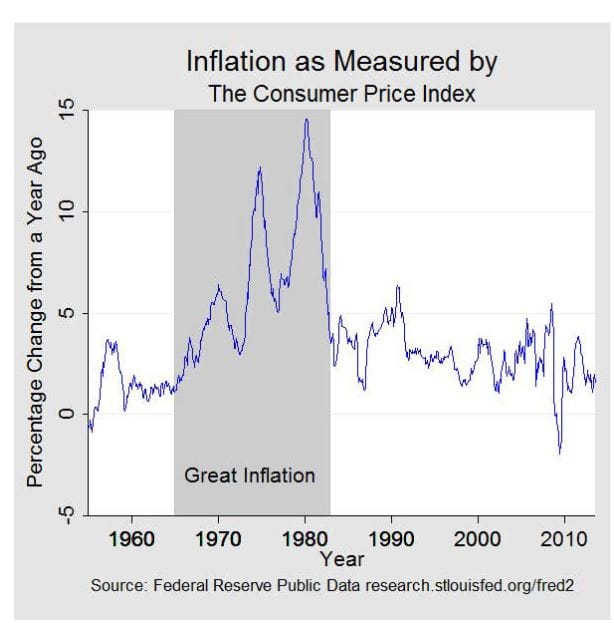

What happened during the “Great Inflation”

The Great Inflation of 1965 to 1982 resulted in the Inflation Rate reaching 15%. There were many international factors at play which were beyond the influence of the Australian Government. The late 1970’s was often described as a period of stagflation. A common feature was slow economic growth and high unemployment and rising prices.

As an investor, I still remember buying a 10-Year Telecom Bond paying 15.6%. I continued to receive this interest payment for the next 10-years, while Inflation rates and bond prices fell. The current Australian 10-year Treasury Bond pays a yield of 4.3% while a 2-year Treasury Bond pays a yield of 3.33%.

As an investor, I still remember buying a 10-Year Telecom Bond paying 15.6%. I continued to receive this interest payment for the next 10-years, while Inflation rates and bond prices fell. The current Australian 10-year Treasury Bond pays a yield of 4.3% while a 2-year Treasury Bond pays a yield of 3.33%.

Strategies for periods of high Inflation

During high Inflation, prices are going to rise rapidly. This may mean you will need to adjust your spending habits as costs will likely be rising above wages growth. You may want to consider diversifying your assets to include investments such as real estate, commodities or inflation-linked securities.

Avatrade offers a detailed list of strategies for periods of high inflation:

- Diversification

- Long term investments

- Real Estate

- Stock Market

- Bonds

- Commodities

Strategies for periods of low Inflation

In periods of low inflation, the government will use monetary policy such as lowering interest rates and fiscal police such as tax cuts and increased government spending. The aim is to encourage economic growth and slow down deflationary pressures.

This consumer has no control over these government measures to halt decreasing Inflation Rates.

Arrowhead Financial Planning has written an excellent article Investing in a Low-Inflation Environment. The key takeaways are:

- Bonds and Fixed-Interest Securities are likely to underperform as they tend to provide lower returns in periods of low inflation.

- Adjust your expectations of return. Don’t overpay for securities when chasing a higher yield. In a period with Inflation Rates of 2% – 2.5%, Real Returns of 5% are worthwhile.

- Take advantage of low borrowing costs and fix the rate for as long as possible.

Subscribe to Financial Mappers Blogs

Please register on the Financial Mappers Blog Page to receive notification when new articles are uploaded.

If you have friends or family who you think would love to have this free resource, please share this article.

To find out more, please watch this short video Inflation.

If you are concerned that the value of your shares may fall in a period of low Inflation, the article How will your shares perform in a falling market? may give you some insights.

Financial Mappers FREE

With Financial Mappers FREE is now available. Click here to join.

Glenis Phillips SF Fin – Developer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.