Interest Rate Risk is the risk of not being able to meet loan commitments should loan interest rates rise. There is a second Interest Rate Risk, where you fix the interest rate on your loan for a term and interest rates fall over that period.

What is a Fixed Interest Rate and what is the Interest Rate Risk

Some lenders may offer you a fixed interest rate for a set term. This term is usually limited to less than 5 years, after which the interest rate will revert to a variable interest rate that may expose you to the Interest Rate Risk, where interest rates are rising.

Lenders may charge a higher interest rate for fixed interest loans, if they believe that interest rates are more likely to rise than fall over the period of the fixed interest loan.

What is a Variable Interest Rate and what is the Interest Rate Risk

Lenders can change the interest rates during the period of the loan. Usually, the lender will charge a margin above the Reserve Bank’s Cash Rate. If the government, increases the Cash Rate, then the Variable Interest Rate will most likely rise by the same percentage.

In the case of rising interest rates, the borrower is exposed to increased Interest Rate Risk. However, if the government decreases the Cash Rate, and the borrower adjusts their interest rates accordingly, then the borrower enjoys the benefit of lower loan costs.

Strategies to help protect you from Interest Rate Risk

The big danger of Interest Rate Risk is that you are unable to fund higher loan payments if interest rates rise. Before you borrow the money, complete an Interest Rate Risk assessment by calculating if loan rates rise between 2% and 4%. If you can’t afford to fund such an Interest Rate rise, consider fixing the Interest Rate. In this situation, consider how you may reduce the level of debt so that when the fixed interest rate period is finished, your loan payments are manageable. As you are likely to suffer penalties if you make additional payments, so you may need to make additional savings during this period and then decrease the amount of the loan and the end of the fixed period.

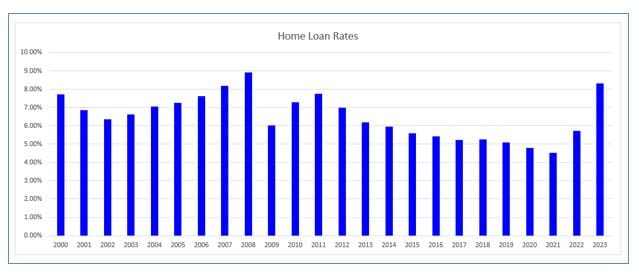

Historical Home Interest Rates and Interest Rate Risk

The graph of Home Loan Interest Rates over a 24 year period from the year 2000, shows a variation of about 4% of this time.

From 2002 to 2008, interest rates rose, exposing the borrower to Interest Rate Risk if the interest rates had not been fixed. However, from 2011 to 2021, interest rates fell each year. This if the borrower had fixed the interest rates during this period, they would again have been exposed to Interest Rate Risk, by not being able to take advantage of the lower interest rates.

It is during these times, one may consider refinancing, however this also comes with the cost of more fees.

What the experts say about changing interest rate costs and Interest Rate Risk

Investopedia is a good resource to provide you with an understanding of the pros and cons of fixed and variable interest rates. The key takeaways from the article area:

- A fixed interest rate avoids the risk that a mortgage or loan payment can significantly increase over time.

- Fixed interest rates can be higher than variable rates.

- Borrowers are more likely to opt for fixed-rate loans during periods of low interest rates.

The Reserve Bank Focus Topic 5.4 is an excellent resource on the topic of Interest Rate Risk.

The Wealth Factory explains “The Impact of Interest Rates on Investments”. Of particular interest, read the following chapters:

- The Effect of Interest Rates on Different Classes

- The Role of Interest Rates in Retirement Planning

- Strategies for Investing in a Rising Interest Rate Environment

- Investing in a Low-Interest Rate Environment

Subscribe to Financial Mappers Blogs

Please register on the Financial Mappers Blog Page to receive notification when new articles are uploaded.

If you have friends or family who you think would love to have this free resource, please share this article.

To find out more, please watch this short video Interest Rate Risk

For further information about Interest Rate Risk, refer to our articles, Impact of a Cut in Interest Rates on your Finances and Importance of Modelling Future Interest Rates for Financial Planning.

Financial Mappers FREE

With Financial Mappers FREE is now available. Click here to join.

Glenis Phillips SF Fin – Developer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.