In response to COVID-19, the Australian Federal Government is allowing people who are financially affected to access up $10,000 this financial year and again in the next year. Many will be wondering if early release of super is a good idea for them.

Implications of accessing your super early

The ATO, has listed the following implications for accessing your super early –

Accessing your super early will affect your super balance and may affect your future retirement income.

Withdrawing superannuation may also affect your:

- income protection insurance

- life / total permanent disability insurance cover.

Insurance may not be available on accounts that:

- are fully withdrawn

- have a balance below $6,000

- are inactive low balance accounts.

You should consider whether you need to seek financial advice before submitting your application for early release of super.

Getting Professional Assistance

The government has provided information about possible implications, however, if you are unsure you can contact your Financial Adviser or Accountant for assistance.

This week, (14th April, 2020) ASIC released a statement regarding relief to financial advisers, who provide advice. Part of this relief is the suspension of the need to provide a Statement of Advice (SOA) about early release of superannuation.

They have also permitted Tax Agents to provide advice without the need to have an Australian financial services license.

These measures should allow you to access advice from either your adviser or accountant for a moderate fee.

Ask your Financial Adviser or Accountant, if they are using Financial Mappers. Here they can demonstrate the effect of early withdrawal of funds from your Superannuation.

ASIC restricts the cost of advice to $300

ASIC has announced conditions under which an adviser can give their clients advice using a much shorter Statement of Advice in their document 20-085MR.

Provided advice relates to early release of superannuation and the cost of the advice is restricted to $300 a much shorter statement, referred to as an RoA (Review of Advice) may be given to clients.

The FPA (Financial Planning Association of Australia) has prepared a templated report based on RG90 (giving scaled advice) for its members. The aim is to assist their members in fulfilling the requirements when writing such a report.

Financial Mappers is one of a small group of FinTech’s who have been working with the FPF in their initiative to make the delivery of advice a much simpler process. The FPA’s aim is to have a broader acceptance of advice delivery through a digital process, in a multi-media format.

On our website, we have a set of example reports developed for giving digital advice or plan reviews through our Client Review App. We have uploaded the FPA’s example of an RoA for advice regarding the early release of superannuation. This new method of digital delivery allows the adviser to share the link with the client and allows the client to ask questions about the advice.

Check out all the report types which have been uploaded into the Client Review App and can be assessed by all.

DIY Investors

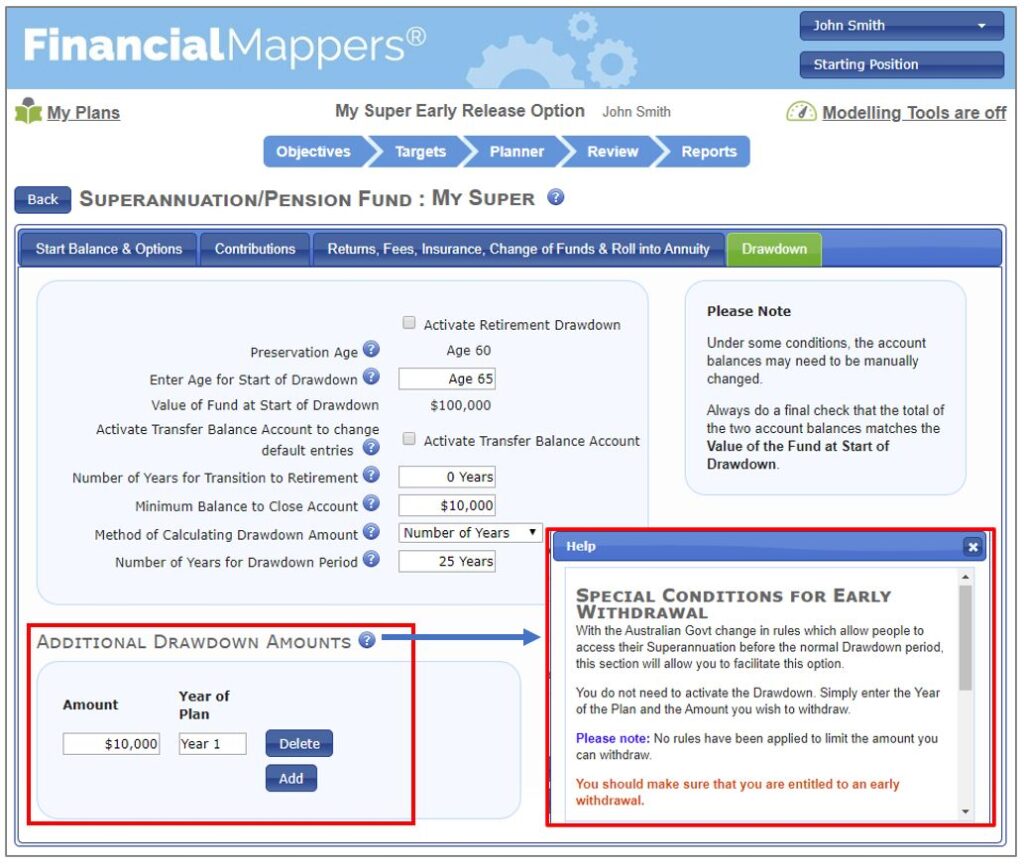

If you are one of the 25% of the population who prefer to be a DIY Investor, you can use Financial Mappers to calculate the effect of withdrawing funds from your superannuation.

If you take this path without seeking professional advice, refer to the Government website to ensure you are eligible and you understand the implications.

For those who expecting to be unemployed over this lockdown period, you may have no choice but to access the funds. If you do have a choice, you may like to do the maths and see if early withdrawal is right for you.

With Financial Mappers, you can make early withdrawals and consider the consequences.

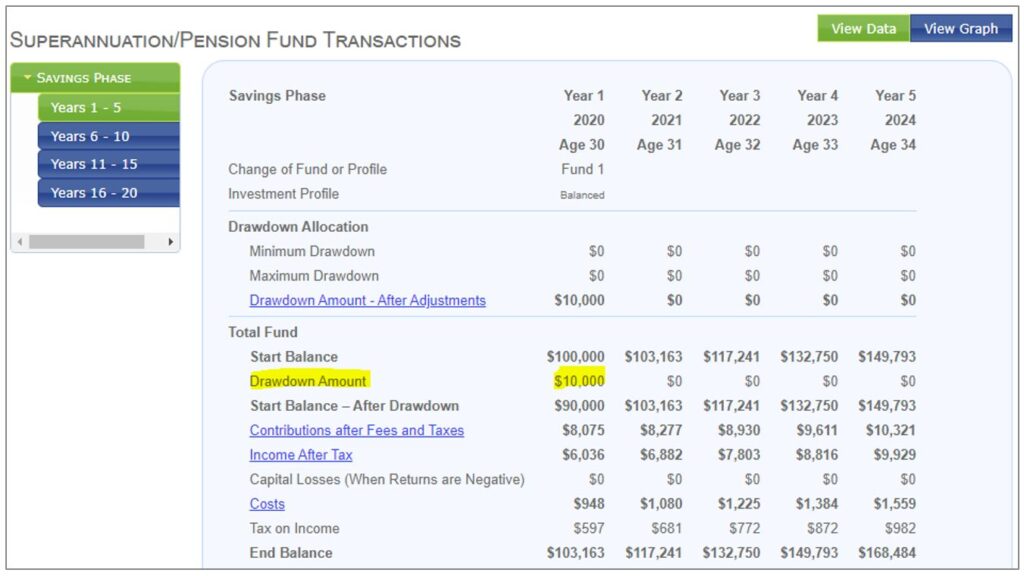

In this example, John Smith, aged 30, has decided to withdraw $10,000 in the first year of his plan.

The consequences of this action are displayed in the Data View of the software.

Financial Mappers

Financial Mappers has superannuation solutions for everyone. Find out how Financial Mappers can help you.

Glenis Phillips SF FIN – Designer of Financial Mappers

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.