The start of June is a good time to review all your income and expenses for the current financial year. There are some items that can’t be back dated, so it is always a good idea to get your accounts balanced and reviewed at least two weeks before the end of the financial year. This way, you can correct any omissions or errors.

I always recommend that you run your calculations past your accountant as there may have been changes to the tax laws over the previous year. One area you may be less familiar with is your Self-Managed Superannuation Fund, if you have one. It is important to remember that as trustee of you fund you are the person responsible for any errors.

The Australian Tax Office is an excellent resource for those considering or already have a SMSF. If you have not followed all the rules for maintaining your SMSF, the ATO may deem your fund non-compliant.

From my research, I find that a fund may be non-compliant if the fund fails either the “Residency Test” or the “Compliance Test”

The “Residency Test” states that the fund is not for a resident of Australia. If you are planning to live overseas for any length of time, you should discuss the ramifications with your accountant.

The “Compliance Test” may be activated if you have not complied with the SIS Acts or SIS Regulations.

If you want to check that your fund is compliant, you can use the Super Fund Lookup.

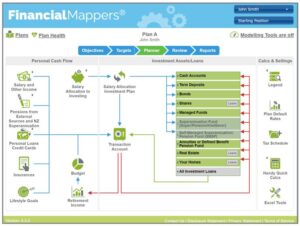

Financial Mappers has a dedicated account for SMSF. Here you can have two members in the fund and divide your assets into:

- A cash account through which all transactions pass

- A combined Shares and Managed Fund Account

- A Property and linked loan account for each SMSF property held in the fund.

For those hold property in their SMSF, this is an excellent resource as you can model when you will need to sell real estate, so that you have sufficient liquid funds to pay your drawdown.

For those with less complex SMSF accounts, the standard Superannuation Account is a simpler option, having one account for each member.

To find out more about SMSF, watch this 10 min Tutorial.

Glenis Phillips SF FIN – Designer of Financial Mappers and Advice Online.

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.