As we start to pack away the Christmas decorations and prepare for New Year celebrations, now is a time to reflect on debt. For some of you, the temptation to overspend during this festive time, may have left your finances in dire circumstances. I hope you are not one of them or perhaps you are trying to help a family member or friend recover from living on borrowed money.

What is Living on Borrowed Money?

The traditional way of paying for your everyday living expenses such as rent, groceries, clothes, or entertainment is to use money earned from employment or from your savings. But some people borrow money to pay for these everyday expenses.

The problem is that you must pay interest on borrowed money, and eventually, the loan amount together with and the interest must be repaid. Sometimes people get themselves into a situation where they don’t earn enough money to pay off the debt.

The problem gets worse as people find fewer borrowers will lend them money and only at exorbitant interest rates. Once you start borrowing from lenders of last resort, you could be paying 25% to 30% pa.

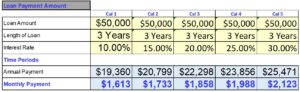

If you have a loan of $50,000 the monthly payments to repay that loan over 3 years will increase according to the interest rate:

In the example above the total interest cost for the 10% loan is $8,081 while the 30% loan has interest costs of $26,413. This is an additional $18,332 in interest costs.

The point to be made here is that there are times when borrowing money is a good strategy. This would be borrowing to buy items that increase in value, such as your home and sometimes an investment. Borrowing for investments can be tricky if the investment falls in value. The interest rates need to be as low as possible.

This article is about borrowing for personal expenses, and in particular, paying for everyday living expenses with borrowed money.

You should set yourself rules about what you should borrow money for and at what interest rate.

Seek Help if you have Excessive Debt

If you are struggling with debt, contact the National Debt Helpline.

1800 007 007

The National Debt Helpline is a not-for-profit organization that will help you tackle your debt problems. They won’t lend you money but the assistance they provide is the first step to resolving your debt problems.

Their financial counselors offer a free, independent, and confidential service.

Take the time to explore all the information on the website. You may be able to work out your debt repayment schedule. If your debt problem is too great, seek assistance from a reputable lender. A good place to start may be your bank as you already have a history with them.

Set your Rules for Debt

Even if you don’t personally have excessive debt, I believe it is financially healthy to develop a set of rules for your debt management. It is also good to discuss these rules with your partner and also your children.

Give your children a healthy respect for debt. It is so easy for them to start on the wrong pathway once they become teenagers if they believe buying things on credit cards is an easy fix to get the things they want. Maybe you can suggest that once they start working part-time while at school, they should set aside some of the money to buy their first car when the time comes.

Every family is different as they have different income streams and different levels of debt. What I would like you to do is review this list of debt situations and make a strategy for each. One that will suit your particular situation.

Home Loans:

- What deposit do I need to secure the lowest interest rate?

- What is the optimal length of loan for me?

- Am I better to repay my home loan as quickly as possible and before I start investing?

- Am I better to repay my home loan before my children reach high school and I have increasing education expenses?

- What percentage of my after-tax income should I spend on home loan repayments?

Car Loans:

- What is the optimal length of a car loan?

- As I repay the current car loan, should I be saving for the next car so that I either have a much larger deposit or can pay cash for my new car?

- How often should I replace my car?

- Am I better to buy a new car and plan to keep it long term?

- Am I better to buy a second-hand car and how often should I replace it?

Investment Loans (Property)

- What deposit do I need to secure the lowest interest rate?

- What is the optimal length of loan for me?

- Am I better to repay my home loan before I invest in property?

- What is your exit strategy? If you plan to sell the property, remember you will incur Capital Gains Tax. If you never sell an investment property, you never pay Capital Gains Tax.

- Will the property provide you with the rental income you require if you plan to keep it in retirement?

Investment Loans (Shares):

- Do I have the investment experience to invest in shares with borrowed money? (Most people don’t)

- Will I sleep nights if I borrow to buy shares, and the investment starts to fall in value?

- What deposit should I have if I plan to borrow to purchase shares?

- What is my exit strategy? What is the best loan format – Interest Only, Interest Only followed by a Principal and Interest loan or a Principal and Interest loan?

Personal (Unsecured) Loans

- Should I borrow to buy things that will not increase in value?

- If I must take a personal loan, what are my rules about the amount borrowed, interest rate, and time to repay?

- Can I create a sustainable Savings Plan to pay for my expenses such as new electrical items or holidays?

I wish all my readers a Happy and Prosperous New Year.

Glenis Phillips SF FIN – Designer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.