Jacaranda season is almost here and for many, they will reflect on the past life of examinations and then taking the next major step in their life. For some, it will be moving from high school to university or starting their first job.

I wonder how many parents and grandparents think “If only I knew then, what I know now about money, how different my life would be”. The greatest gift you can give your child is the tools to ensure the same mistakes are not made.

I would like to introduce Bruce Christie, author of “My Money Mentor”. He has written the perfect introduction to the world of finance for your children. If you have children who are stepping out into the real world, where they must take responsibility for their financial future, this would be the perfect gift.

Bruce Christie is a retired financial adviser who has had over 30-years of experience in helping people manage their money and grow their wealth. The initial book was written for Bruce’s children and grandchildren so they could benefit from his years of experience and avoid the financial mistakes he made in his early years.

His children encouraged Bruce to publish this book so others could benefit from his wisdom. Bruce is a volunteer with CCNB, a charity on Sydney’s Northern Beaches as well as a mentor for small businesses.

All profits from the sale of this book are donated to charities who are committed to providing financial education to young Australians.

I urge you to support Bruce by buying this book or make a donation to one of these charities. It is such a worthy cause.

I think young people will benefit from this book because it sets down in plain English how they can start their young life able to ignore all that advertising encouraging them to buy things they can’t afford and which can lead them into an ever-growing cycle of debt.

More importantly, the book addresses the financial decisions which need to be made in the early stages of their working life. This information is incredibly important and some parents may also lack the knowledge to assist.

In any case, parents should encourage their children to be independent by doing their research and make the decision that is right for them.

It is time for your children to accept financial responsibility as young adults.

This book starts in chronological order, addressing the financial challenges which are likely to occur first. These are subjects like buying their first car or applying for credit and debit cards.

I believe the book will resonate with young people because Bruce has used real-life examples of how young people have made either good or poor financial choices and how this changed their financial future.

From my experience, many people avoid the challenge of learning more about good money management because the moment they open the book, it is littered with lots of unfamiliar money language they don’t understand.

Bruce has skillfully avoided this trap. He explains only what needs to be understood and takes away all the mystery. Sometimes he will even say, this topic may be boring, but you need to understand these key things.

While young people may not be thinking in terms of buying a home or investing, the book will whet their appetite so that when they are ready to take those next major financial decisions, they will be prepared.

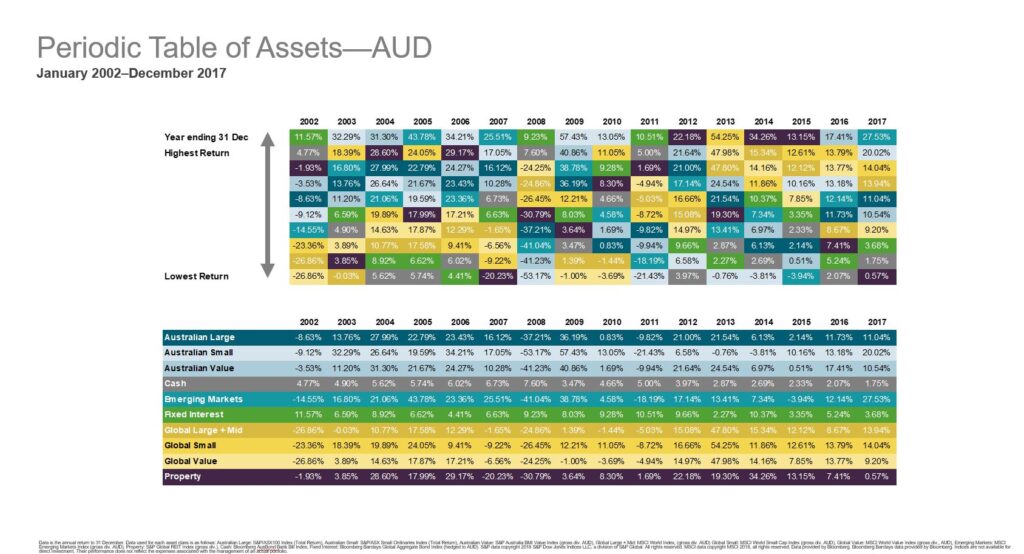

For me, the highlight of this book was a wonderful pictorial of how the value of assets change over time. All too often people have very short memories of past financial crises and how people were affected. For young people, they are unlikely to have any memory of such events.

Yet when I talk to people in the forties, they remember when their parents had to sell the family home because they could not afford home loan rates of 15.6%. If they had investment property loans that were not regulated by the government rates went to over 20%.

Young people are likely to expect that home loan rates will remain at under 5% when the average home loan interest rate over the last 20-years to closer to 7%.

People tend to think that both shares and property just continue to grow in value year after year. Both these investments over the long term have indeed been a great place to invest. But if you buy at the top of a market and are then forced to sell when the price has fallen, severe losses can be incurred?

Only by looking at this pictorial can the reader see just how much things can change in a very short time.

The pictorial demonstrates that property was the lowest performer in 2007 with a loss of over 20%, yet for five of the sixteen years, property was ranked in the top two categories.

The equity markets are divided into subcategories and again this information will reveal that not all shares perform the same, but again, in general, their performance has been sound.

Visit Bruce’s website, Money Mentoring to purchase this book in either digital or hard copy.

Glenis Phillips SF Fin – Good Financial Reads

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.