Numeracy is a word we don’t hear in everyday conversations or think that improving our numeracy skills will have a long term impact on our financial well-being. Numeracy is knowing and understanding mathematical concepts that can be used in every day situations. Numeracy skills allow you to critically evaluate mathematical information.

The HILDA Report

The HILDA Report (House, Income and Labour Dynamics in Australia) gathers statistical information from which it reports on matters relating to Australians. One important report is that on evaluating the Financial Literacy of Australians.

A summary of the findings are:

- 55% of adult Australians are financially literate

- 69% of adult males are financially literate

- 48% of adult females are financially literate

In 2106, the HILDA Report surveyed 5 financial concepts. Each of these concepts will be discussed in separate Financial Mappers Blogs in the section Financial Literacy. The 5 financial concepts are:

- Numeracy

- Inflation

- Diversification

- Risk and Return

- Money Illusion

Numeracy Skill 1: The Power of Time & Compound Interest

If you invest $100,000 at 5% interest paid annually for 10, 20 and 30 years, how many times the original investment amount of $100,000 will you earn in interest. It is important to remember you only invest the original amount of $100,000. The reason the interest earned over 30 year is more than 3 times the original investment is called Compound Interest. That is that at the end of each year, the interest is paid on the original investment of $100,000 plus any interest earned in the previous year.

The lesson to be learned is that the sooner you start saving, the greater will be your final wealth and less you will have to save from your earnings.

Another way of looking at this may be to think about saving $50 a week, which would be $2,500 (50 weeks). If you are earning 5%, your savings for the following time would be:

- 10 years: $32,200

- 20 years: $ 84,700

- 30 years: $170, 200

Numeracy Skill 2: Increasing the number of times your interest is paid each year

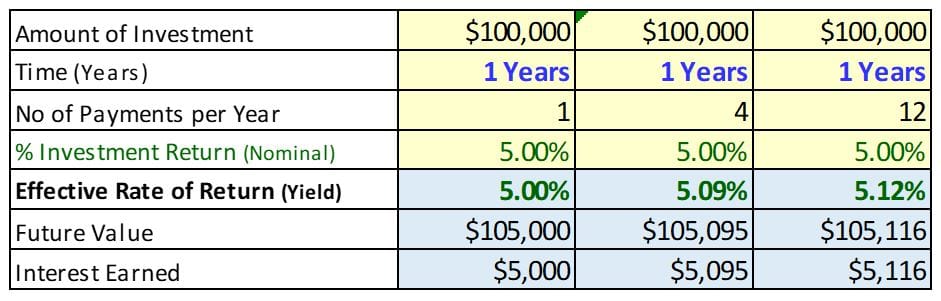

The more frequently your interest is paid, the greater the interest. As you can see from the graph below, the interest earned on $100,000 at a nominal rate of 5% will increase from $5,000 to $5,095 if paid the interest is paid quarterly and $5,116 if the interest is paid monthly.

Looking at the table below you will see that while the nominal interest rate is 5%, the Effective Rate of Return increases with the number of payments each year. Where the interest is paid quarterly, the Effective Rate of Return is 5.09% and increases to 5.12% where the interest is paid monthly.

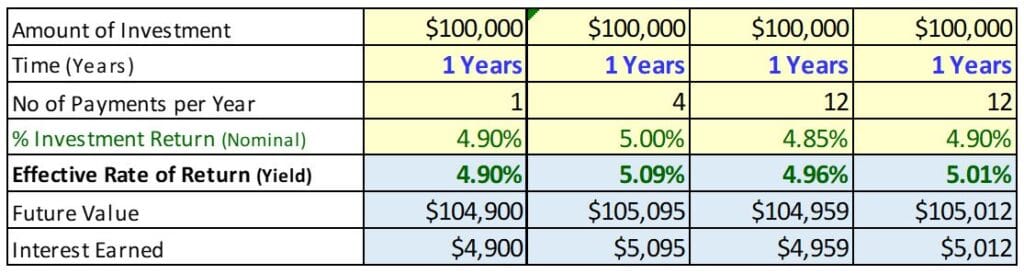

When you are selecting an investment, you should always calculate the Effective Rate of Return to find the highest interest rate. Here are a set of examples using different nominal interest rates and different compounding periods. The critical percentage to review is the Effective Rate of Return.

Fees and Bank Charges

While you should be able to calculate the best interest rate should be relatively simple, working out home much you pay in fees is often complex. The types of fees you may encounter are:

- Monthly Account Keeping Fees: charged Monthly

- Transaction Fee: charged per transaction

- Dishonoured Payments: charged if you don’t have sufficient funds in your account and the transaction is cancelled

There may be value in choosing a Savings Account with a lower interest rate if there are no or reduced fees charged.

Subscribe to Financial Mappers Blogs

Over the coming weeks, I will be presenting a series of articles to help build your financial skills. Please register on the Financial Mappers Blog Page to receive notification when new articles are uploaded.

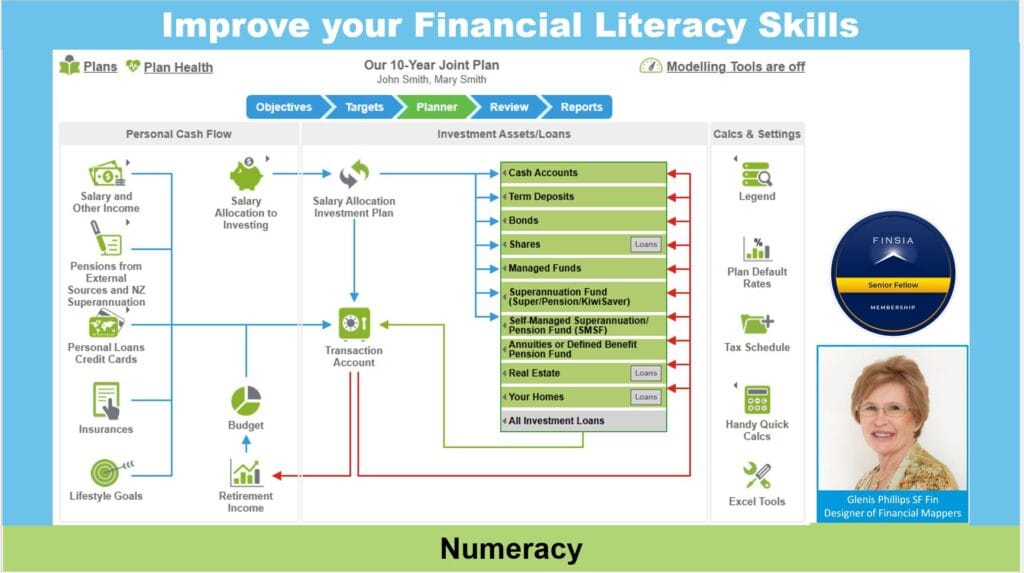

You will also be notified when our new software Financial Mappers Free is available. This will enable you to make a 5 Year Financial Plan, free of charge.

If you have friends or family who you think would love to have this free resource, please share this article.

To find out more, please watch this short video Numeracy

For more information, I would recommend my article Allocate Savings to Investments with Financial Mappers.

As we have been discussing the importance of time when savings, I think you will find my article The Investing Philosophy of a 92 year old Self-Funded Retiree of interest.

Glenis Phillips SF Fin – Developer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.