In 2022 Real Estate prices rose 27.5%, but reports indicate that with rising loan costs, this bull market is likely to stop. To what extent future real estate prices change is anyone’s guess. Both the optimists and the pessimists will all be promoting their views. Use caution as you glean information from the Internet about future Real Estate Prices.

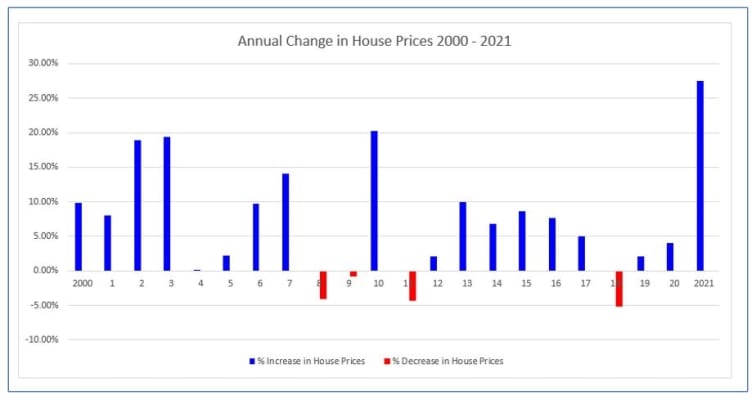

To start the discussion, review the rise and fall of Real Estate Prices between the years 2000 and 2021.

As you can see there are significant yearly differences. How well your property performs is often determined by the economic cycle in which you purchased the property. Those who can purchase property during a downturn are most likely to have greater profits, provided they can hold the property long term.

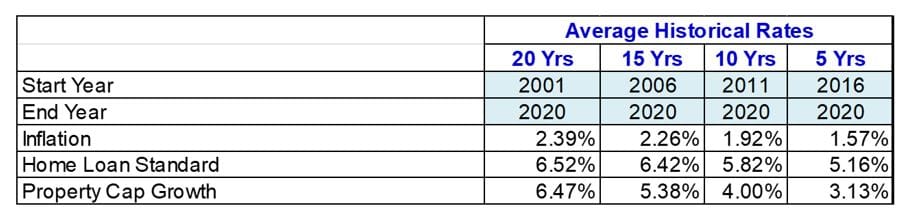

The nature of estimating future capital growth is usually based on past performance. Generally, if one plans to hold Real Estate long-term one would use long-term average capital growth rates to estimate future capital growth.

Here is a table of historical data over various time periods ending in 2020. I have not included the last year, 2021, which had exceptional growth of 27.5%. Do remember the standard warning that comes with any reference to average returns and past performance:

Past performance is NOT a reliable indicator of future returns.

Factors Affecting Real Estate Prices

A common saying is that the three most important factors affecting real estate are “Location, Location, Location.”

Another common saying is “Buy the worst house in the best street”

According to Investopedia, there are 4 Key Factors that Drive the Real Estate Market.

These factors are:

- Demographics: The importance of what people currently living in a location may do in the future or their demands in the future will play an important factor in how the Real Estate prices in that area may change.

- Interest Rates: As Interest Rates rise, the cost of servicing a loan is higher and may reduce the number of people who can afford to purchase. In times of rising interest rates there may be more mortgages in default, which lenders will sell quickly at a reduced price, thus pushing down the market value further.

- The Economy: The overall economy will play a role. It is generally expected that when the economy is sluggish, Real Estate prices will also be sluggish. People will be fearful of losing their job or other investments likely to fall in value.

- Government Policies/Subsidies: The Government has just released the October 2022 Budget and there does not appear to be any significant changes except that the downsizer contributions have been lowered from 60 years to 55 years. It is too early to know what affect this may have on real estate prices.

Buying the Best Property for You

Real Estate Prices & Investing

There is a big difference between buying Real Estate for investment rather than your home. With investment property you must take a clinical look at each property and buy the one which is going to serve your needs. Investment in Real Estate should be a long-term investment. The high buying and selling costs and the time to sell make this an illiquid asset.

Every Real Estate investor will have different needs and each investor should look to buy what Real Estate is going to best serve those needs.

The needs to be considered are:

- Cash Flow: Do I need a property that is self-funded and have I considered the effect of an interest rate rise of 2%to 3%.

- Income Tax Strategies: As interest costs are Tax Deductible, do I want to increase the value of property to be purchased so I can minimize my tax payments? However, if using this strategy, make sure you have an “Exit Strategy” as to how and when the loan will be repaid.

- Capital Gains Tax Strategies: Capital Gains Tax is not paid until the property is sold. I have a favorite saying – “If you never sell your Real Estate, you never pay Capital Gains Tax”. Capital Gains Tax is calculated by adding 50% of the profit to your Taxable Income and that share of profit will be taxed at the marginal tax rate in the year of the sale. Where you have held a property for a very long time this can be a significant part of your profits. You only have the profit less Capital Gains Tax to reinvest.

- Find a Seller who is forced to Sell: Regardless of general market conditions, there will always be people who must take whatever price is being offered on the day. The most common causes for this are divorce settlements, loss of employment or having committed to another property purchase before selling the current property.

- Long Term Maintenance: This is something that is often overlooked. I recommend investors create a 10–15-year budget for maintenance and then divide that amount by the number of years. You should then set aside an amount of your rental income for large expenses. One of the advantages of buying an apartment is that the Body Corporate has made those calculations and you are billed every quarter to create a Sinking Fund for these costs.

- How easy will it be to sell the Property: Generally speaking, if you buy real estate that is going to be attractive to the average person, you will have a greater pool of buyers. For example, if the average house price in the area is $500,000 and there is a small cluster of houses priced a $1,000,000 in the same area, there is likely to be a much smaller market for those more expensive houses. If you need to reduce your price by, say 10% to make a quick sale, the difference will be $50,000 for the average house and $100,000 for the more expensive house.

- How easy will it be to rent the Real Estate: Every week a property is vacant, waiting for a tenant is money lost and you may need to subsidize the loan payments while waiting for a tenant. A good strategy is to choose an area where you know there is a high demand for rental properties. For example, is the property in a desirable school catchment area, there will be a higher demand to rent in that area. In this case, Real Estate prices are often out of the budget for many and thus they will need to rent while their children attend those desirable schools. Those renters will pay a premium in rent costs to achieve the education goals they have for their children.

- Future Personal Use: Consider if the strategy of buying a property that could be converted to your retirement home in future years. Let the tenants pay off your retirement home.

Recommended Reading

No matter how many books I read, I always find a few “gems”, I had not considered. As the author Good Financial Reads, please read by book reviews. These two books may give you some ideas on the type of book you may find helpful.

Investing in the Right Property Now: Margaret Lomas is recognized as the “Guru” of real estate investing and you won’t be disappointed with any of her books – Highly Recommended.

Bullet Proof Investing: James Fitzgerald provides a wealth of real estate knowledge to help you choose the right property for you.

Glenis Phillips SF FIN

Explore Real Estate Options with Financial Mappers

Financial Planning Software for Real Estate and other Investments

Financial Mappers is an excellent product for Independent Investors, Financial Advisers, and Mortgage Brokers to explore any “What If Scenarios” relating to Real Estate. This dynamic financial planning software will automatically update results and generate new reports as the parameters of the property or loan are changed.

Here is a selection of “What If Scenarios” you may want to explore:

- The effect of increasing the deposit to loan ratio

- The effect of using Interest Only or Principal and Interest Loans, together with a combination of both.

- The effect of increasing interest rates on loans

- The effect of changing the estimated long-term capital growth

- Calculation of profit and Capital Gains Tax if the property is sold

- Include future renovations and capital purchases

- Include Depreciation and Building Write-offs

- Manage Real Estate purchased in your SMSF

Watch Video

To find out more please watch this 3-minute video Real Estate.

Glenis Phillips SF FIN

Further Reading

Check out these other articles about Buying Real Estate:

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.