When you are young and for some who are already in their 40s, living on your Retirement Income seems irrelevant. It is something that can creep up on you and suddenly you find you can’t afford all the things you had dreamed of in retirement.

You are never too young to start saving for your retirement. Remember our discussion of Compound Interest. By starting early, your investments will be growing passively from the interest earned on those investments. This means you can use less of your savings from salary to create the same retirement nest egg. Or perhaps you can retire sooner if you have saved sufficient to fund your retirement.

How much capital do I need to fund a retirement income of $80,000.

An income of $80,000 in today’s dollar value should allow you to have a comfortable retirement lifestyle that could include restaurant meals, hobbies and travel. Depending on the type of your investments, you are likely to need between $1.45 million and $1.7 million in savings. The more investments held in growth assets such as superannuation, shares and real estate, the less you are likely to require.

Growth assets should return between 4.5% and 5.5% (before inflation). Defensive assets such as interest earning accounts are likely to return between 2% and 3% (before inflation). This would require an allocation not only in cash management accounts but also Term Deposits and Bonds.

Investment Types

For many, Superannuation will be a large part of their investments. The government has rules in place whereby a minimum amount must be drawn down each year. In the 2024-25 year, the minimum amounts range from 4% for those under 65 to 7% for those aged between 80 and 84. The percentage will increase from age 85. Currently there is no limit on how much you can draw down.

About 20% of the population will hold some of their investments in investment property. Provided there is no debt, the investment should provide a regular income. However, you have a planned maintenance regime. Something like a large renovation may take most of the retirement income to fund the renovation in that year.

Depending on your investment skills, you may choose to invest directly in the share market or investment in Managed Funds. There is a large selection of assets that can be held in Managed funds. With either investment type, these funds are generally more liquid, and you can draw down funds to supplement your retirement income. If you don’t wish to hold real estate directly, you could choose a Property Trust, commonly referred to as REITs.

Interest-earning assets are more liquid and more defensive. Generally, there is no capital growth component. The exception is bonds. Provided you hold the investment till maturity, all your capital will be returned at maturity. If you are forced to sell the bonds on the open market, the price you are paid will depend on the current interest rates. If interest rates are higher, the value of your bond will decrease. If interest rates are lower, the value of your bond will increase.

Develop a layered income stream

From these investments, you can develop a layered income stream.

The first consideration should be whether you want to have a higher retirement income stream when you first retire. Alternatively, you may decide to work part-time to supplement your retirement income.

The second consideration should be to what extent you want to be “Hands On”. You could decide to draw down all your shares before you start to draw down your managed funds. If you hold real estate, you should determine if you will need to sell it at some stage in retirement. If so, look to see when is the most tax effective time to sell the property.

Most superannuation funds give you the opportunity to change the investment profile. One common strategy for superannuation is to move from ahigh growth fund to a more defensive fund as you age.

Home ownership

Home ownership will lower your cost of living as the maintenance, rates and insurance are likely to be less that rent for an equivalent home. Owning your own home, debt free may allow to you downsize when you retire and use the surplus to invest.

Lifestyle choices

For many, retiring may leave a very large gap in their time. Some may take up hobbies which require a considerable amount of money and recurring costs.

A good example is the large boat which is a renovator’s dream. The hobby will happily take large sums of money to restore the boat and once it is ready for using, there is a considerable ongoing cost which should be accounted for in your retirement income.

Another example is travel. While some may want to take overseas trips, others may be preferring to travel about Australia. Travel costs too will bite into your retirement income.

There is nothing wrong with any of these lifestyle choices, provided you have allocated funds for their costs in your retirement income. You may require an income much higher than $80,000.

Poor health and long-term care

Australia provides institutional long-term care for about 20% of the population who are eighty years or older. This percentage will increase if you live beyond the average life expectancy.

While we all wish for a long and heathy life, it would be prudent to have an Emergency Fund, to cater for such an event where one’s health deteriorates. The situation becomes more complex where one partner is healthy and the other is not.

As the Baby Boomers progress to the last stage of their life, the government is going to be faced with increasing health costs and less income as more of the population are not working. It is likely to require the government to find more ways to tax these non-working citizens and expect them to pay more of their health costs.

This situation is again likely to have a negative impact on retirement income.

Subscribe to Financial Mappers Blogs

Please register on the Financial Mappers Blog Page to receive notification when new articles are uploaded.

If you have friends or family who you think would love to have this free resource, please share this article.

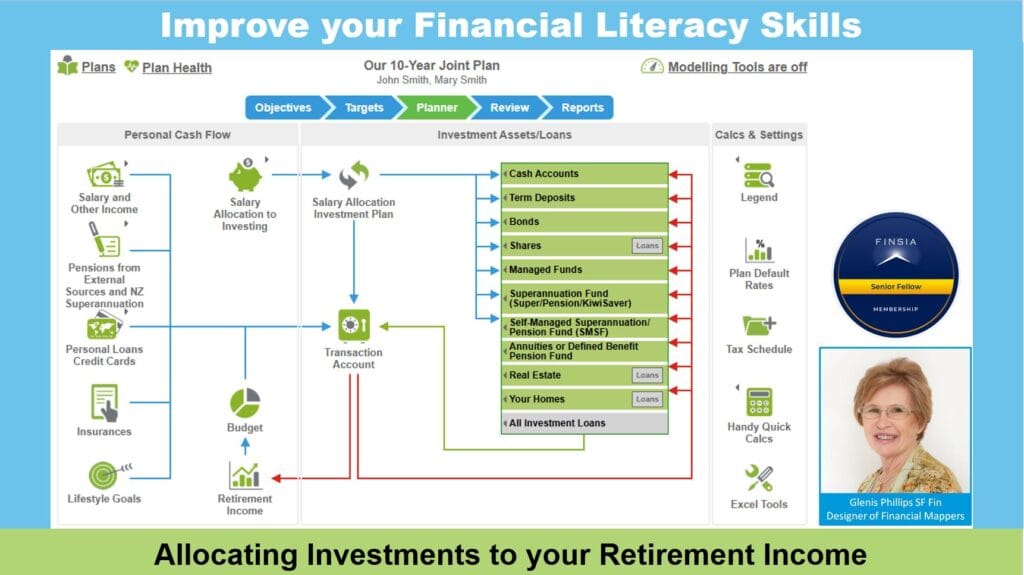

To find out more, please watch this short video Allocating Investments to your Retirement Income.

Financial Mappers FREE

With Financial Mappers FREE is now available. Click here to join.

Glenis Phillips SF Fin – Developer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.