Rising Interest Rates should be a concern for all borrowers. The RBA raised interest rates by 0.25% in May 2022 and a further 0.5% in June, July, August, and September. This was followed by a 0.25% in October, November, and December. February 20023 saw another 0.25% interest rate rise. The RBA suggests that there are likely to be more increases in interest rates until the Inflation Rate meets its Target Rate of 2.5% to 3%.

Since the GFC, interest rates were low. Now inflation is on the rise. It should be no surprise to anyone that increasing interest rates to long-term average rates is a highly likely scenario.

The RBA released a statement after its June 7th (2022) meeting. For those who want more information, consult the Statement by Philip Low, Governor on the Monetary Policy Decision. This may help you form a personal view on the likely changes in both interest rates and inflation.

The final summation of the statement was:

The Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead. The size and timing of future interest rate increases will be guided by the incoming data and the Board’s assessment of the outlook for inflation and the labour market. The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time.

Philip Low

The popular press seems to think most people have been taking advantage of the lower interest rates to repay their debts faster. In addition, banks have been raising the benchmarks when assessing new borrowers’ ability to pay with higher interest rates. Hopefully, most people have been taking a sensible view of their debts and will not suffer financial stress because of recent interest rate rises.

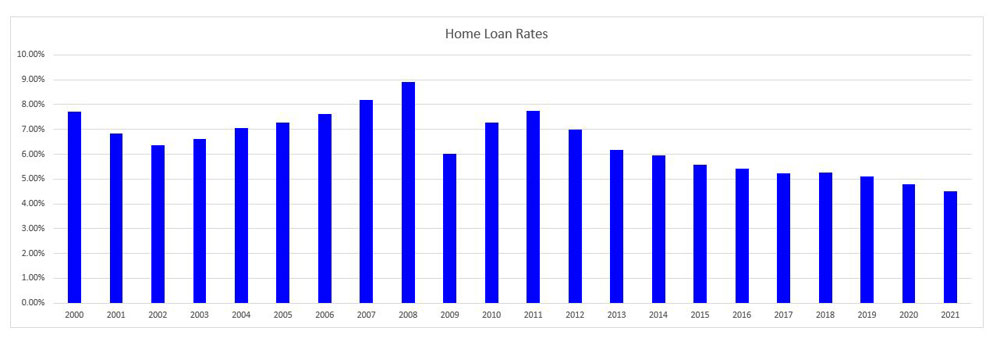

However, predictions are that interest rates are likely to rise further, and could reach the point when the increased rates cause financial stress for some. This graph shows the average standard variable home loan rates between 2000 and 2021.

Home loan interest rates 2000 – 2021

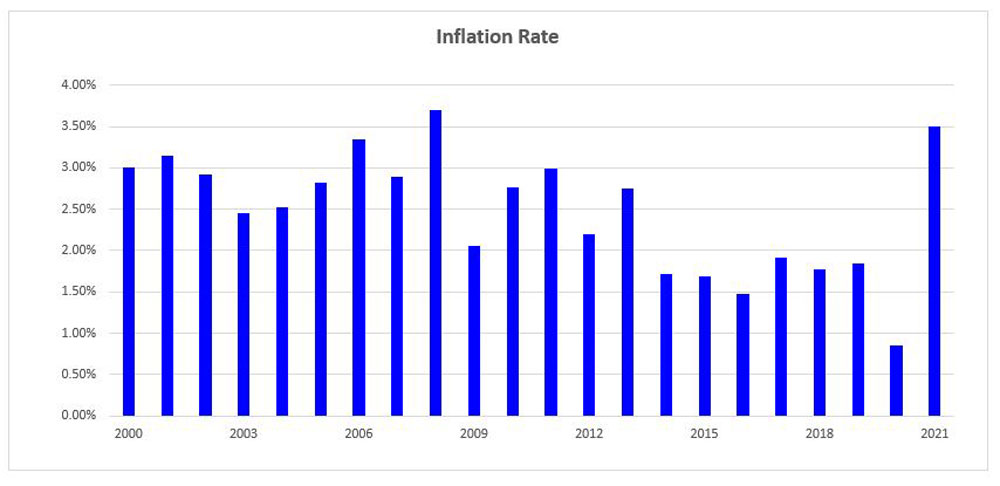

Current Inflation has risen to over 5% in the last 12-months. This graph shows the average inflation between 2000 and 2021.

Inflation rates

The RBA statement estimated that by raising interest rates, inflation would return to the target rate of between 2% and 3%.

This graph shows the average Inflation Rates between 2000 and 2021.

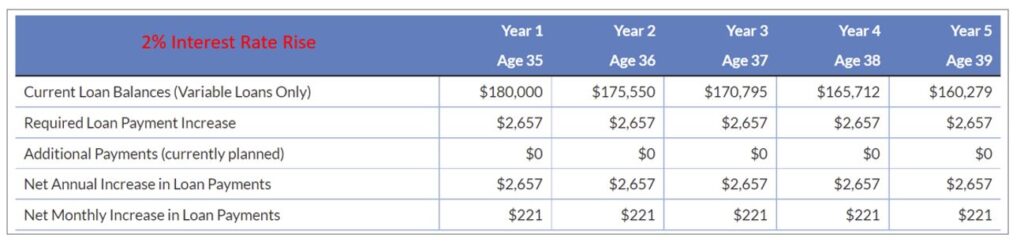

With Financial Mappers, there are several tools to assess the effect of rising interest costs. The Debt Management Report will show the effect of raising interest rates by a nominated percentage, say 2% over the next 5-years.

How to calculate the effect of rising interest costs with Financial Mappers

Financial Planning Software to Develop “What If” scenarios

With Financial Mappers, there are several tools to assess the affect of rising interest costs. The Debt Management Report will show the effect of raising interest rates by a nominated percentage, say 2% over the next 5-years.

In this example, there is only one home loan and no additional loan payments have been planned. Note that the monthly increase is $221.00.

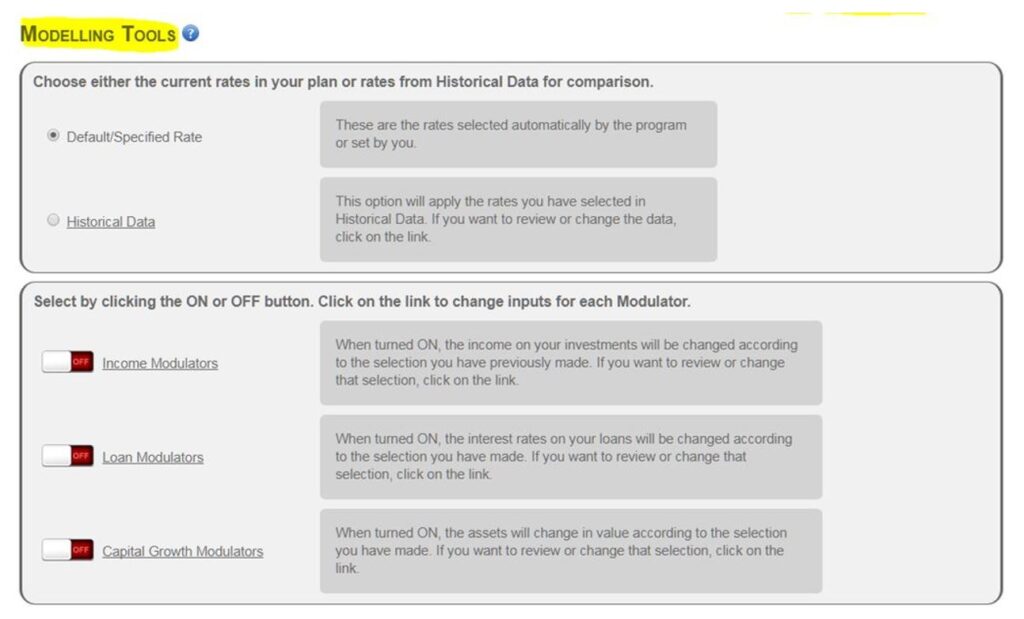

Financial Mappers has a comprehensive set of Modelling Tools.

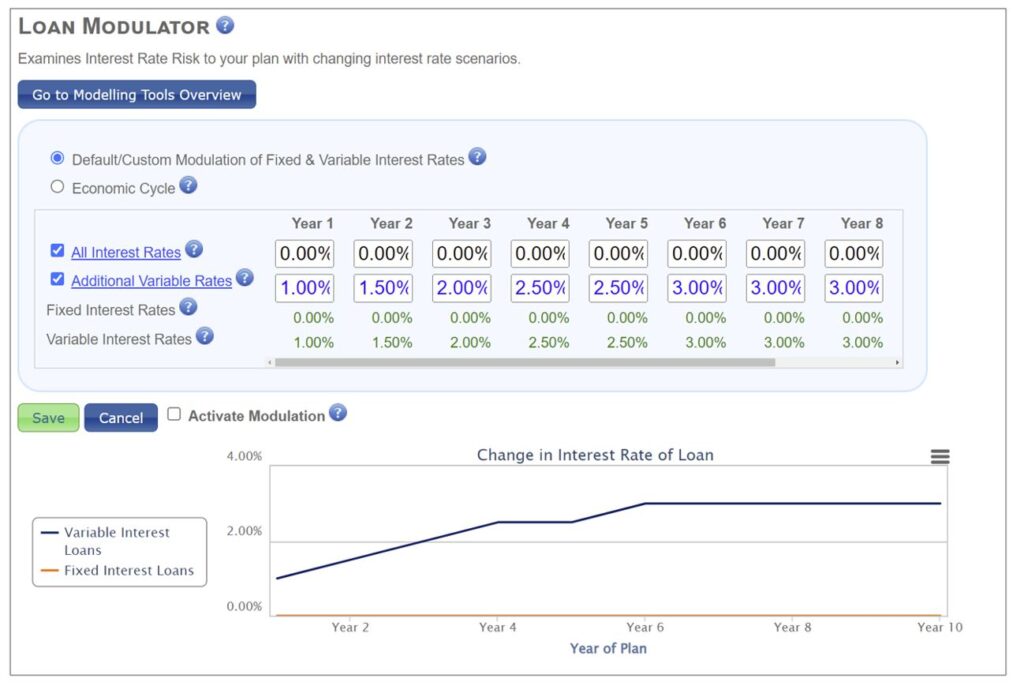

The Loan Modulator can be used to assess the effect of rising interest rates.

In this example, the Variable Interest Rates, rise by 1% in the first year and then 0.5% each year, until they have increased by 3% from the current rates.

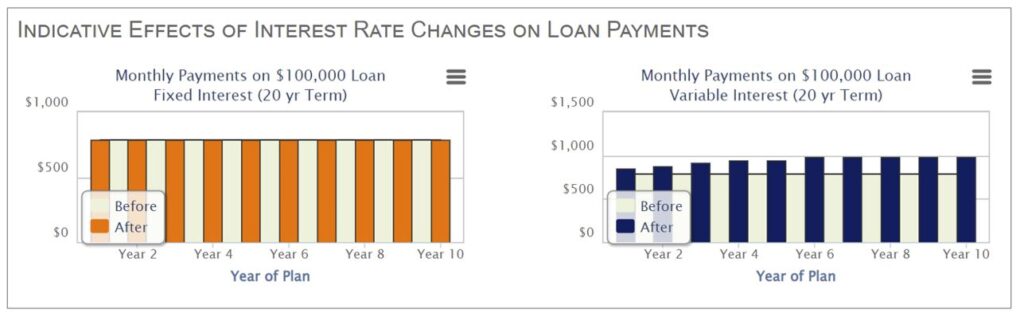

The Loan Modulator includes a graph of the Indicative Effects of Interest Rates on a $100,000 loan.

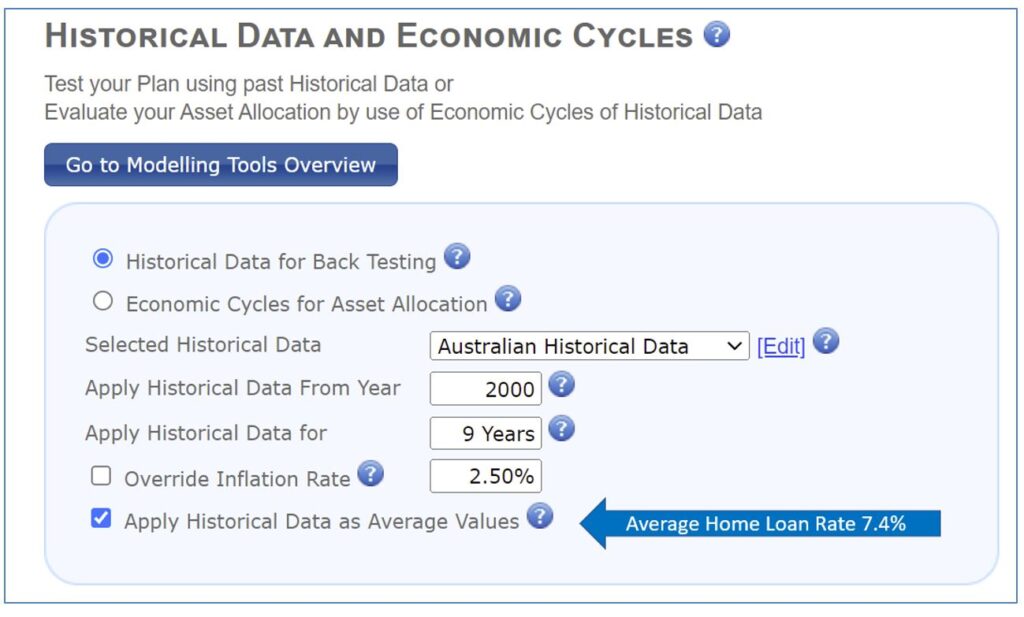

A second option would be to consider the cost of your current loans if you were to select a historical period where loans rates were higher.

For example, between the years 2000 and 2008 the average home loan cost was 7.4%.

Why you need a Financial Plan

Not only are loan costs likely to rise, but it is predicted that energy and fuel costs will rise, in addition to our everyday living expenses.

Now more than ever, it is time for everyone to make a Financial Plan. This will allow you to calculate where you can make savings in your Living Expenses and how you can better manage your debt. If you can afford it, now may be the time to seek expert financial advice.

Watch Video

If you are an Independent investor consider watching this video, Why you Need a Financial Plan.

Are you ready to start your Financial Plan?

Glenis Phillips SF Fin – Designer of Fin

Further Reading

Check out these additional articles I have found for you.

- Effect of Raising Interest Rates (Tejvan Pettinger from Economics Help)

- Up and up: What does an Interest Rate Rise mean for Australia (Kate Bettes from UNSW Sydney)

- What do Rising Interest Rates mean for you? (Colonial First State)

- RBA Cash Rate for October raised to 2.6% (Mortgage Forum)

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.