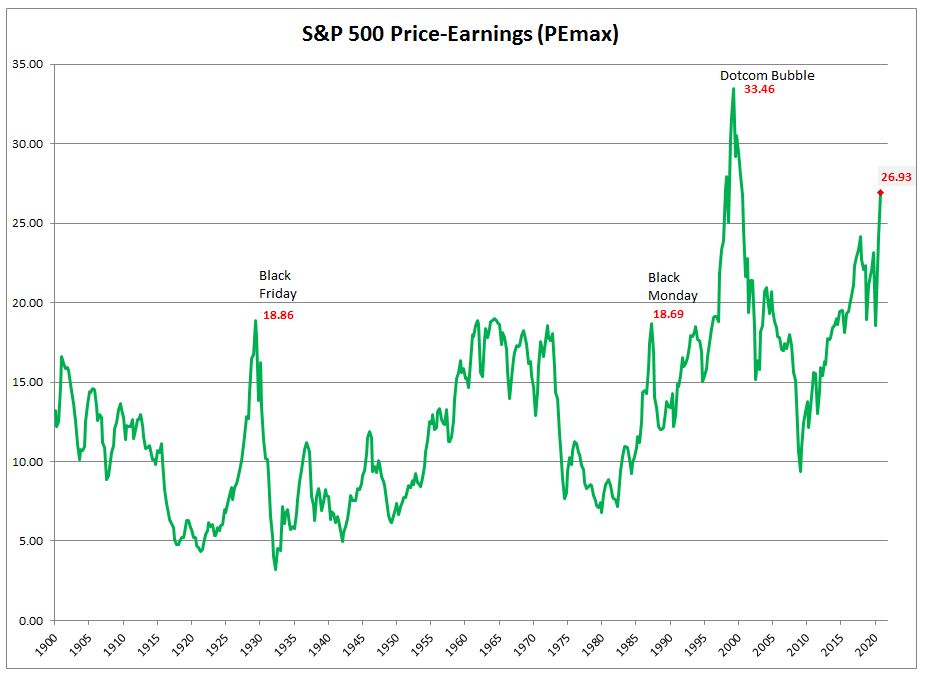

I am increasingly seeing comments where blog writers refer to the past share market bubbles, suggesting another bubble may be forming. As I commenced 2021, I found myself reflecting on the global economic effect of COVID-19 and government stimulus packages. As I manage my SMSF, I worry about the best way to protect my wealth in times of extreme downturns.

This chart is typical of the type of information regarding share market bubbles.

I have experienced all the stock market bubbles from 1978. I am pleased to say that I managed to negotiate them relatively unscathed. However, I am constantly looking for advice that may help me protect my wealth should another major downturn occur.

While talking with an experienced commodities trader, she recommended that I read Stocks on the Move by Andreas Clenow.

This is a short book that is best suited for those who self-manage their wealth, particularly those with a considerable asset allocation to shares. To implement the strategies recommended, you would require access to charting software that allows you to sort shares using indicators.

If you are like me, and not looking to change the management of your shares, but rather strengthen the rules around which you manage your portfolio, this book has a wealth of information.

The strength of this book is the great insights given as to how to manage a share portfolio during a severe downturn.

Some people simply assume the market has gone too high and exit the market completely. However, keeping all your funds in interest-earning assets also exposes you to other risks.

The Preface of the book, states

What this book tries to offer is a clear and systematic way of managing a portfolio of momentum stocks.

I believe the book delivers.

The book demonstrates how the risk can be reduced by applying some simple rules to shares you purchase and later how to sell. If you agree with any of the rules, these can be applied to your current trading rules for the entry and exit of shares.

While the book discusses in detail “Momentum Trading”, which is different from “Trend Trading”, it is a very thought-provoking book for any person who is investing in the share market.

While it is not appropriate for me to give away the “secrets of the book”, I can advise you that I believe the author brings to the conversation some sound concepts which have not been explained as well in other trading books.

I always purchase hard copies of my share trading books as I did in this case. However, this is one of the rare occasions, where you could purchase a digital copy as the graphs are not as important as the philosophy of setting yourself rules to help protect your wealth in severe share market downturns.

Given the small price and ease with which to read, I would recommend this book to anyone concerned about how to manage their investments should a downturn in the market occur.

Glenis Phillips SF Fin – Good Financial Reads

Further Reading

You may like to read some of my other book reviews for Share Trading:

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.