Prior to legislative changes in 2016, accountants could provide financial advice. Since then, only accountants with an Australian Financial Services License (AFS) or an authorized representative of a AFS holder, can provide financial advice.

Most accountants see their role as providing tax advice, business finance advice and asset protection.

The dilemma for accountants is knowing the client’s financial intentions.

Usually, the accountant meets with a client once a year, just prior to preparing their tax return. In the intervening period, clients are talking with friends and associates about investments and often they are persuaded to invest in similar assets without first seeking professional advice as to the suitability for their financial situation.

Thus, the client often arrives at the meeting with news of new investments that have been undertaken during the year. By this time, it is too late for the accountant to recommend suitable tax saving strategies. Before an investment is undertaken, consideration should be given as to which name the investment should be purchased and if it is wiser to invest in an entity such as a trust or a superannuation fund.

Prior to making an investment, an exit strategy should be developed, taking into account the ramifications of capital gains tax and inheritance. This is where an accountant provides a very valuable service.

Financial Mappers is a good solution for Accountants

One solution to knowing the client’s financial intentions is for accountants to recommend clients purchase their copy of Financial Mappers.

Clients are then able to create a financial plan. Accountants can ask their clients to generate a report called ‘Plan Summary the First 5 Years’.

For each year of the plan, the following information is provided:

- Assets at Start of Year

- Liabilities at Start of Year

- Net Value of Assets at Start of Year

- Statistics & Asset Allocation

- Personal Income and Expenses (Excluding Investment Expenses)

- Investment Income and Expenses (Including Home Loans)

- Saving Allocation from Salary

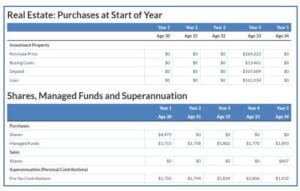

- Real Estate Purchases at Start of Year

- Shares, Managed Funds and Superannuation

- Loans

- Loan Balances and Loan Repayments Schedules

- Interest Rates, Capital and Interest Payments

- Current Insurance Protection

This is an example where an Investment Property is purchased in Year 4 and the client is making regular savings to a High Growth Managed Fund and Pre-Tax Personal Superannuation.

If you are an accountant and see value in this strategy, you could recommend clients read the Financial Mappers blog ‘Are your Tax Affairs ready for End of Financial Year’. This article explains how clients can work with their accountant using Financial Mappers. Not only does it allow the client to show their future intentions in relation to investments, but also provides a Financial Literacy Program to help clients better understand their finances.

If you would prefer to have a white labelled product, consider one of the options available with the Enterprise Version of Financial Mappers, where no financial advice is provided but clients can make plans, generate reports and send to the accountant.

Glenis Phillips SF FIN – Designer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.