When even the government recognizes that providing clients with a 100-page document full of legalese and saying the same thing in three different ways is wrong, we know that change is coming to the way in which financial advice is provided to clients.

With the release of the Quality of Advice Review (QAR), the government has accepted 14 of the 23 recommendations, but implementing these recommendations is likely to take a long time. From what I read some advisers have stated that it is not only the government, but also their compliance staff who insist on more than is required from the current legislation. This could be a timely reminder for advisers to talk to their compliance staff and ask them exactly what is the minimum requirement under the current legislation.

It may be that you can consider the idea of providing a strategy document that does not recommend specific financial products and insurance but rather a broader approach. This may be suitable for clients wanting low-cost advice.

Top three things clients want from their Adviser

I asked Google, the font of all knowledge, “What do clients want from their financial adviser”. Here are some of their answers:

- Consumers want advisers who are knowledgeable, trustworthy, and good listeners. (Good listeners is probably one that goes under the radar.) They also want the adviser to consider their ESG preferences when building an investment strategy.

- Consumers also want someone who will understand their situation, educate them, respect their assets, no matter how small, and finally solve their problems and not pitch products.

- Consumers who are investors want a real person to talk to and discuss how real-life events could affect their finances.

Heart of Advice

The article Heart of Advice – What do Clients Want from their Advisor, published by eMoney in July 2023 is a very good review of what the American client is wanting from their financial adviser. The question is whether the service offered matches what the client is looking for. The younger demographic is looking for help with smart budgeting, changing spending habits like saving for large purchases and improving their financial literacy skills. It was found that clients don’t want advice that is overwhelming. Research showed that 22% of consumers were dissatisfied with the advice given because it was too complex.

I believe that Australian consumers are looking for similar outcomes.

Can AI Help?

AI may help to reduce the cost. A recent article (Nov 2023) in the Australian, AI’s impact on financial advice will bring a new dawn in wealth, discusses whether or not AI is likely to be a threat or a help for advisers who are looking to spend their time more efficiently.

Advice Intelligence founder, Jacqui Henderson said:

AI could be a co-pilot in providing financial advice but should not be given control of the plane.

According to the article, AI could be used as a hyper-realistic video avatar of the adviser to deliver a personal message. My immediate thought was that advisers are already recording video messages of their advice, so I could not see this having any significant impact on the advice process.

As a result of that article, I decided to invest in some AI voice generating software. Sometimes I pay for a professional voiceover and at other times I use my own voice when the videos are long and used for training. I wrote my scripts for a couple of very short video clips and used the software to generate the voice. The voice was certainly better than my voice, but not as good as the professional voiceover. The problem was getting the pronunciation right. You were able to modify the pronunciation, but to do it you really needed skills in writing phonics. At the end of the day, I don’t think it will save much time.

There was a time when Robo-Advice was put forward as an alternative to a real financial adviser, but time has proven, this idea has not been taken up by the consumer.

Whether people want to get fit or improve their financial situation, most people need a face-to-face person to manage them. Given human nature, I don’t think this is likely to change anytime soon.

Financial Adviser Report

In 2022, Finder published its Financial Advisor Report.

Here is a quick summary of what they found:

- 16% of Australians (3,200,000) use a financial advisor.

- The top reason most Aussies don’t use a financial advisor is that they prefer to manage their own money (42%).

- The second most common reason is that it is too expensive (39%).

- Most Australians (57%) aren’t prepared to spend anything on financial advice.

- The rest of the country is prepared to pay $1,164 on average for financial advice.

In the article, How much does a financial adviser cost? Canstar (June 2022), found that comprehensive advice was about $5,000, but this could be reduced to about $3,500 when consideration was given to those clients wanting limited advice only.

There is a great divide between what the average client is prepared to pay and what advice costs. Of course, the cost will change depending on the income and assets of the client. Currently it seems access to paid advice is restricted to high-net-worth clients because of the cost.

The unfortunate thing about the current advice system is that those who most need financial advice can’t afford it. They are restricted to gathering their information on Internet sites.

There must be a better way for both consumers and financial advisers.

Software may be the Solution

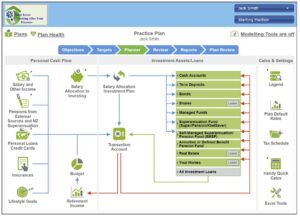

With Advice Online, the client completes a Fact Find, from where the adviser imports the information into a plan. The adviser optimizes the plan, writes advice specific to the plan and generates the Advice Record. The client logs into the portal and views the Advice Record, together with both interactive and PDF-style reports. Using the Dashboard, the client can move the slider to any year and review the details or open a graph for the length of the plan.

Financial Mappers is a much more comprehensive product with many more features. However, there is the ability to deliver advice in a similar way. Using the Client Portal, the client can view the adviser’s plan where it has been shared, create their own plans, and have a more comprehensive set of reports.

Both products provide an inbuilt Financial Literacy Program and deliver the advice in small bite-size pieces. By reducing the length of the plan and the advice provided in the initial stages, the client is not overwhelmed. Once the client has absorbed and understood the high-level advice, the adviser can reach out to ask if they would like assistance with product selection or other services such as estate planning or a review of insurance.

To save significant time, I feel the relationship between the adviser and the client needs to be a collaborative one. This would include the client completing a Fact Find. Yet I am constantly told by advisers that their clients are not tech savvy. I think in this day, most people should be capable of completing a simple Fact Find. The secret is in keeping it simple, but getting the information the adviser needs to create a financial plan based on the client’s current assets.

Multimedia Interactive Reports

In 2019, the FPA asked a small number of FinTech’s to create a digital format for the Statement of Advice. The product we designed was very well received at the conference. From here we have developed what we call Multimedia Interactive Reports.

Want to see how it works, watch this video created for Advice Online.

Glenis Phillips SF FIN

Designer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.