While people know their chances of winning a big Lotto prize or one of those dream homes promoted by Art Unions is very low, the philosophy seems to be that “Someone’s got to win it and you don’t have a chance if you don’t buy a ticket”. Many people probably think the spending of a few dollars is worth the dream of deciding what they would do with millions of dollars or that fantastic house. At least the profits benefit important charities and it allows you to have a Financial Dream.

The fact is that every person can set themselves realistic dreams and then work out a financial plan to build the wealth to achieve those goals.

The secret is to start saving now!

When you are creating your budget, the most important thing is to allocate what percentage of your income you will allocate to savings FIRST. The longer you delay, the greater percentage of your savings you will need to allocate.

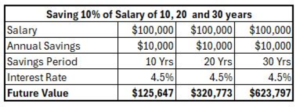

Look at this table where a person has a salary of $100,000 and saves 10% of Salary ($10,000) over 10, 20, and 30 years. (Results do not include inflation or tax paid on interest)

While saving 10% of your salary in the early stages of your working life, may be a struggle, the rewards are evident. The important thing to remember is that you should commit to a Savings Plan as early as you can. Perhaps start with saving just 5%.

While saving 10% of your salary in the early stages of your working life, may be a struggle, the rewards are evident. The important thing to remember is that you should commit to a Savings Plan as early as you can. Perhaps start with saving just 5%.

The value of your home should be considered as part of your accumulated wealth. Therefore, you may use those savings in the early stages to secure a deposit for your home. While you won’t earn any interest on your home investment, the value of the home will rise in value.

Make your Financial Dreams your Financial Goals

Financial Dreams should be converted to Financial Goals. You may have short term Financial Goals such as saving for a car or a holiday. One significant long term Financial Goal may be to make yourself financially independent in retirement.

Financial Mappers can help you formulate a financial plan to meet your Financial Goals.

Lifestyle Goals are short term goals saved over an allocated period. For example, you may want to start saving for your next car or overseas holiday so that when the time arrives, the money will be safely in your bank account, and you won’t need to borrow for these personal expenses.

Long term Financial Goals for Home and Investments can be allocated as a percentage of Gross Salary. The Investment Plan allocates all loan expenses, net of income and is displayed as red in the graph. The shades of blue are interest earning accounts, orange as allocations to Shares and Managed Funds and finally the purple displays allocations to personal Superannuation Contributions.

In the graph below, Years 6 – 10 allocate 80% of savings after loans to shares, with the balance to the Transaction Account.

Everyone has their personal Dreams. Now you can stop dreaming and take steps to make them a reality.

This video called “What’s Your Dream” was created back in 2014. While the figures don’t take into account the inflationary increases, the message is still the same.

Financial Mappers gives you the confidence to reach the destination you want.

Please take the time to enjoy!

Glenis Phillips SF FIN – Designer of Financial Mappers and Advice Online

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.