“When is the best time to start investing?” is a question often asked. The simple answer to those who have not made an investment plan is that they should make it a high priority, preferably starting today. Investing is a crucial step towards financial independence, allowing individuals to build wealth over time. The earlier you start, the more time your money has to grow through the power of compounding.

You may not realize it but anyone with a Superannuation Fund has an investment. In July. 2025 the contributions made on your behalf by your employer will be 12% of your salary. This is a substantial saving. You can also make personal contributions, but you should consider whether it is a good idea to have most of your investments in one entity and whether any rules regarding your superannuation may prevent you from early access if required. The big unknown is what changes the government may make to superannuation in the future.

Investing also requires ongoing education and monitoring. The financial landscape is constantly changing, and staying informed about market trends, economic indicators, and changes in regulations is essential. Regularly reviewing your investment strategy and adjusting your portfolio as needed can help you stay on track towards your financial goals. Consider following reputable financial news sources, podcasts, or taking online courses to enhance your investment knowledge.

Additionally, consider your investment timeline. Are you investing for short-term gains, or is your focus on long-term growth? For short-term goals, look for less volatile investments, while for long-term objectives, you might take on more risk for potentially higher returns. Understanding your goals will guide your investment strategy and help you choose the right assets to include in your portfolio.

Moreover, it’s essential to understand the different types of investments available. Stocks, bonds, mutual funds, and ETFs (exchange-traded funds) are common investment vehicles. Stocks represent ownership in a company, while bonds are essentially loans to corporations or governments. Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks and bonds, while ETFs are similar but trade on exchanges like individual stocks. Each of these options carries different levels of risk and potential return, so it’s crucial to do your research before diving in.

A common misconception is that investing is only for the wealthy. In reality, anyone can start investing with a small amount of money. Many platforms now offer low-cost or no-cost investment options, allowing you to begin with as little as $100. Consider starting with a robo-advisor, which can help manage your portfolio based on your financial goals and risk tolerance. For example, platforms like Betterment or Wealthfront provide automated investment services, making it easier for beginners to enter the market.

According to Google:

To achieve a comfortable retirement at age 67, a person earning average wages in Australia would ideally need a superannuation balance of $595,000 for a single person and $690,000 for a couple.

It’s also important to consider how inflation affects your retirement savings. Over time, the cost of living increases, and your savings need to outpace inflation to maintain purchasing power. Historically, the average annual inflation rate in Australia has been around 2.5%. Therefore, if your investments are returning less than this rate, your purchasing power is effectively shrinking. To combat this, consider investment options that have the potential for higher returns, such as equities, which, while riskier, can offer better protection against inflation.

According to ASFA:a single person can enjoy a ‘comfortable lifestyle’ on around $51,000 a year while a couple would need around $72,000 a year. The decision for you if whether you want to be more than ‘comfortable’. If so, you need to create an investment plan.

It’s also crucial to set clear financial goals. Are you saving for a home, children’s education, or retirement? Defining these goals will help you determine your investment strategy and how aggressively you need to invest to meet those objectives. Use tools like SMART (Specific, Measurable, Achievable, Relevant, Time-bound) criteria to set these goals accurately.

If your investment knowledge is limited, a good place to start is reading some books about the topic. Good Financial Reads, Financial Mappers Blog page, has a substantial list of recommendations. I think the last book Strong Money would be an excellent start.

Besides reading books, consider joining local investment clubs. These clubs allow you to meet like-minded individuals, share insights, and learn from each other’s experiences. Participating in discussions can deepen your understanding of investment strategies and market dynamics. Online forums and communities can also be beneficial for exchanging ideas and staying motivated.

The second source of investment you may not have considered is the equity in your home. A common strategy is to use all your investment savings to repay your home as quickly as possible. The reason is that the interest charged on your home loan is not tax deductible. In addition, the equity in your home can be used as security should you choose to borrow funds for your investments. In this situation, the most common investment is real estate. Borrowing to invest in shares may be considered ‘too risky’ for those with limited investment skills. When you retire, you may downsize, leaving you with money to invest.

Furthermore, understand the importance of risk management. Diversification is key; don’t put all your eggs in one basket. Instead, spread your investments across various asset classes to mitigate risks. This means balancing your portfolio with stocks, bonds, real estate, and other assets. Regularly rebalance your portfolio to maintain your desired risk level as market conditions change.

Equity investing is another strategy worth exploring. Beyond just real estate, consider buying shares of companies you believe will grow over time. Think about investing in sectors that align with your interests or expertise. For instance, if you’re passionate about technology, researching and investing in tech stocks can be both fulfilling and potentially lucrative.

It is generally accepted that any investment portfolio should be diversified with allocations to superannuation, real estate, shares, managed funds and fixed interest securities.

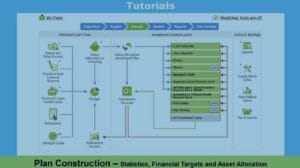

This is where Financial Mappers software can help you plan your investment future. Not only can you plan your investments, but the software also includes a financial literacy program so you can build the skills you need. In the Retirement Phase, you can create a layered drawdown of your investments and let you see how long your funds will last.

Lastly, don’t forget to review your progress regularly. Set up a schedule to evaluate your investments and assess if you’re on track to meet your financial goals. Life circumstances can change, and your investment strategy should adapt accordingly. Consistent monitoring allows you to make informed decisions and pivot when necessary. Remember, investing is a journey, and staying engaged will yield the best results.

The role of a financial advisor can also be beneficial, especially for beginners. A good advisor can provide personalized guidance based on your financial situation and goals. They can help create a tailored investment strategy and point out potential pitfalls to avoid. However, it’s essential to choose an advisor who is transparent about their fees and has your best interests at heart.

The video, Plan Construction – Statistics, Financial Targets, and Asset Allocation demonstrates how this can be achieved.

Glenis Phillips SF Fin – Designer of Financial Mappers

In conclusion, understanding the best time to start investing is crucial for building a secure financial future. By starting early, educating yourself, setting clear goals, and diversifying your portfolio, you can navigate the investment landscape effectively. Investing is not just a way to grow wealth; it’s a pathway to achieving your life goals and securing your financial freedom.

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.