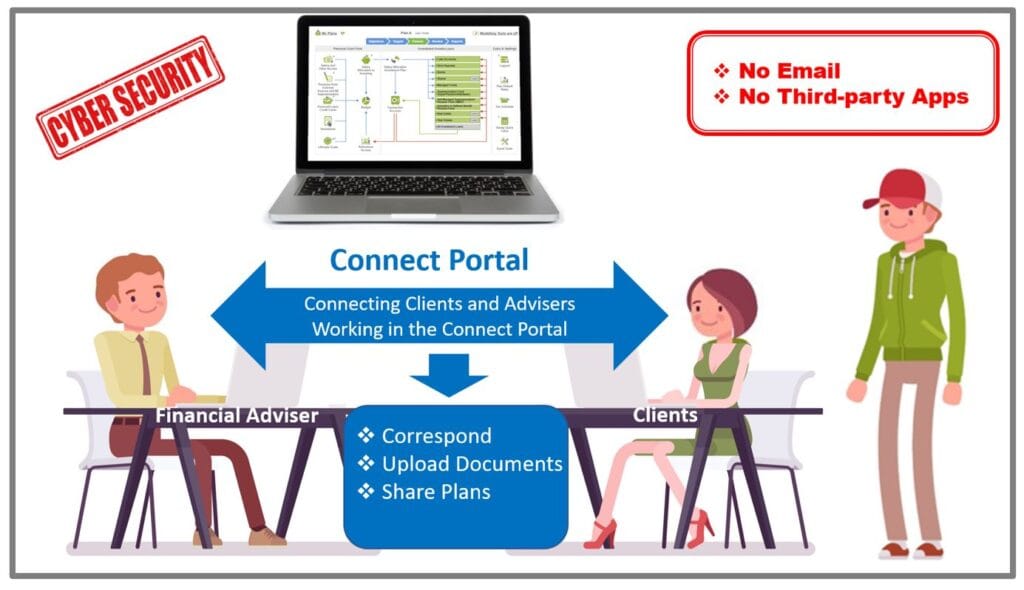

As a Financial Adviser, what will you say to your client, the next time you send sensitive information through email and then be told the client’s email account has been hacked? For increased cyber security stop sending information via email and select a secure Client Portal.

In August 2022, the Professional Planner published an article “The Death of email and what advisers need to change for security”.

Financial Mappers Pro has upgraded its software to include all the recommendations made by Adele Martin and Paul Moran, in the article. Adele and Paul are two of the most respected Financial Advisers in Australia.

Review our Announcement – Financial Mappers Upgrade to Improve Cyber Security.

We call our Client Portal, the Connect Portal.

The Client Portal allows advisers and clients to correspond, upload documents and share plans. Each party can view the various conversations.

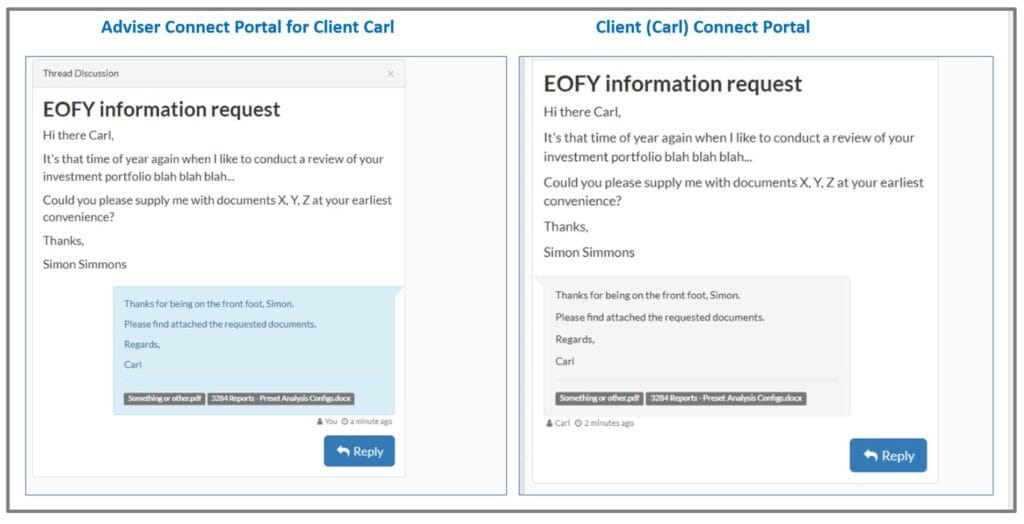

Here is an example of the financial adviser asking the client to provide some end of financial year documents and the client replies uploading the documents in the Client Portal.

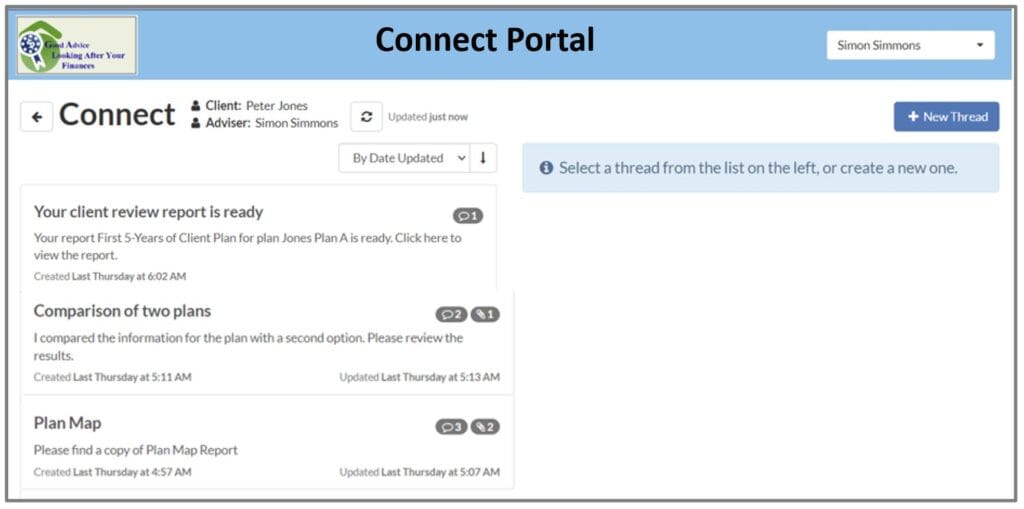

These conversations are segregated into “Threads”, so it is easy to return to the Client Portal at any time and find the thread.

Financial Planning Software for Financial Advisers

New Developments with Client Portal

Financial Mappers was one of a small group of FinTechs invited to design a product that delivers a Statement of Advice in a digital format that the client will understand. We launched our Client Review Gateway at the FPA Congress 2019.

Where a Financial Adviser chooses to use the Client Review Gateway as a digital tool of demonstration during face-to-face meetings, the adviser can then upload the details of the meeting, through the Client Portal. There remains the option to email for those advisers not using the optional feature of allowing clients to have their own account and access to the Client Portal that we call the Connect Portal.

In September 2022, the Professional Planner conducted a webinar Quality of Advice Review with Michelle Levy, (Lead of the Quality of Advice), Sarah Abood (FPA executive), and Matt Lawler (AMP Advice managing director)

It was indicated that in the future, the role of SOAs and ROAs will be diminished or replaced. There is likely to be only “Personal Advice” which must meet the requirement of being “Good Advice”. It has been indicated by Michelle Levy in her webinar that advice does not need to be written advice. Other alternatives include advice by video or direct conversation. However, the adviser would need to keep a record of the contents of this advice. Using the Client Review Gateway, the adviser can upload both mp4 and mp3 files in the documents section.

To increase cyber security, we recommend Financial Advisers, upgrade all clients to Lite Connect Clients. This will allow all information to be exchanged between Financial Adviser and Client using the Client Portal.

The added advantages of the Client Portal for Lite Connect Clients are:

- A Financial Literacy Program is built within the software

- The Financial Adviser can choose to share the first 5-years of a recommended financial plan

- The Client can create their own 5-year financial plan and use the software to explore financial concepts explained in the Financial Literacy Program

- Enables Clients to be part of the financial planning process and will keep Clients engaged with the adviser.

Adele Martin made the comment to the Professional Planner regarding the use of video and educational content for Clients:

“This is good for a couple of reasons; it means the client meetings aren’t rushed because they can watch things in their own time and understand it better and it saves the adviser a lot of time because you’re not repeating yourself and they’re getting your best version.”

Financial Mappers has undergone the completion of videos to onboard clients to the software and teach Clients the basic concepts of money management. A more educated client is more likely to understand the advice being given and want to become more involved with the process.

In relation to cyber risks, Paul Moran recommends that practices to be signed off every quarter for antivirus protectors, password protectors and two-factor authentication (2FA).

Financial Mappers provides 2FA for both Financial Advisers and Clients. Paul Moran made the comment to the Professional Planner about 2FA:

“When clients understand we’re taking it seriously enough to do this, if they don’t want to do it then that’s their call, but that’s not the adviser’s call.”

Cyber security will increase in importance as more software and email hackers try to invade both the financial adviser and clients’ digital tools and emails.

Watch Video

To find out more about our recent software upgrade, please watch this 90-second video – Connect Portal – Securing Messaging and Uploading of Documents for Financial Advisers.

Glenis Phillips SF FIN – Designer of Financial Mappers

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.