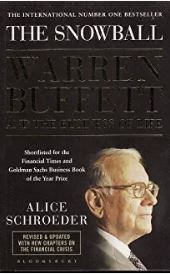

Warren Buffett will go down is history as one of the most influential people of his century. His biography ‘Snowball’ by Alice Schroeder, gives great insights into why this man has become a legend in his own lifetime.

The book reads almost like a diary, from the time he was a child. Warren Buffett was never an ‘overnight success’. Even as a child he had unique qualities which were always going to make him a standout success. By his early twenties, he had amassed a considerable sum of money. For those of you who never seem to be able to save, Warren lays out the cold, hard facts of life. If you want to get ahead financially, do not waste money on ‘possessions’ you don’t need. Even to this day, he lives a very modest lifestyle.

Warren’s achievements go way beyond that of how to invest. It’s it is his belief in being completely honest, and working in the best interests of his investors that is a rare quality. He thinks of people who have entrusted their money to him as his partners. It is often quoted how his partners were made millionaires by having faith in Warren’s investment style. However, you had to have absolute ‘faith’, because Warren insisted on not telling his partners what he was investing in and they could not receive any dividends – everything was reinvested.

I think this is one of the reasons his investment style was so successful. Through secrecy, he was able to find companies that were truly great investments but were currently undervalued. He could find the opportunities without broadcasting the information to would be copycats.

I don’t believe that anyone doesn’t know that Warren Buffett’s style of investing is based on the work of Benjamin Graham. That is, he looks for companies whose underlying assets are worth more than the company price, if the company were liquidated. That is, their intrinsic value is greater than the company. From that basic principal, he has increased the potential to increase profits by seeing future areas of growth. Generally he does not take a ‘hands on’ approach, but rather provides the capital to let the original owners use their knowledge and skill of the industry to increase profitability.

There are many people who claim they use the Warren Buffett methodology of investment. However, this is not possible in this day and age, because the Internet has made so much financial information readily available to everyone. Besides, they don’t have the ability to hold majority shareholdings and sit on the boards of large organizations such as the Bank of America.

Even rarer is his philanthropic work where he has donated billions of dollars to charity. Both he and his wife, Susie, wanted to leave the world a better place. Their tireless work to improve ‘the lot’ of the less fortunate throughout the world will indeed leave the world in a far better place.

For me, what was interesting was that Warren Buffet did not always make the right investment decisions. This usually occurred because of unknown events which overtook the purchase. At times, he had investments which were a drag on the company’s profits for many years. Sometimes, he was able to turn the situation around and of other times, he decided to sell. This made me feel a whole lot better about my investment decisions which have not gone the way I had hoped. If Warren doesn’t always get it right, what chance have I.

On the other hand, he has become at some stages of his life the richest man in the world. So any distractions to his great skills must be set aside.

This book is extremely long, with a lot of information about his personal life, which may not be of interest to everyone. However, having lived through all the financial crises mentioned in the book, I found, the more I read, the more I wanted to get to the next chapter to see what happened. The story embraces all his relationships, both personal, political and in business. Over the years, he has developed strong personal friendships with people who, like himself are some of the most influential Americans of this generation. Together they have been able to achieve great things.

I don’t like to spoil a ‘Good Financial Read’ by telling too much of the detail. However, I can say I thoroughly enjoyed reading this book. It has given me much to think about, not only in the world of investing, but how as a person, I can make the world a better place in some small way.

This book can best be summed up by a quote from The Times –

‘An epic account of the greatest capital accumulator in history’.

Glenis Phillips SF FIN – Good Financial Reads

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.