Glenda Nicholls BDM (Financial Mappers) describes advice modelling as a crystal ball which is suitable for accountants, brokers, and advisers.

For accountants who provide SMSF advice, our Pro version is the perfect tool to demonstrate your advice and write your SOA. For those who want their clients to better understand their finances and bring a concise report of what they plan to do over the next 5-years, accountants can be a referral partner. This entitles their clients to a discounted price for the online version of Financial Mappers.

If you are coming the Business Accounting Expo, please visit our stand.

In December, the IFA Adviser’s Guide was published. The focus of the annual supplementary was

FULL STEAM AHEAD: A number of new trends are expected to propel the financial advice sector down the path of revolution.

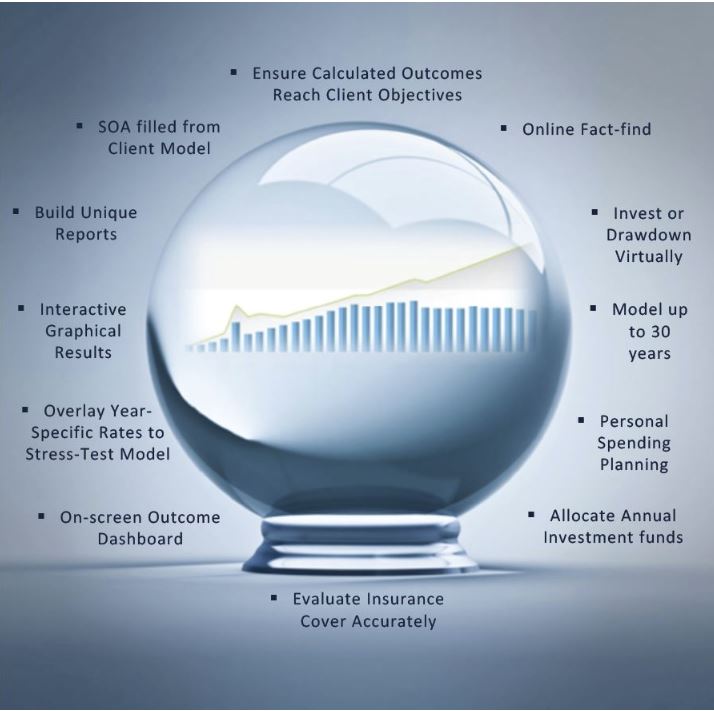

In the magazine, Glenda Nicholls describes Financial Mappers as Advice Modelling – A Crystal Ball.

This is how she describes Financial Mappers for anyone in the financial services industry:

Advice Modelling – A Crystal Ball for You and Your Clients

How do your clients know whether your advice is going to really achieve their objectives?

How do YOU know it?

For advisers who have their clients’ best interests as a priority, Financial Mappers PRO is personal finance modelling software that allows future projections of clients’ complete personal cash flow, investing, and retirement funding plans.

This means that the various components of your advice such as assets bought and sold, loans acquired and paid off, or drawdown strategies to fund retirement – can all be entered, and the projected results on their complete financial picture are then reported.

THE COMPLETE CALCULATOR

Financial Mappers Pro is both one calculator of your client’s entire financial position, and a series of specific calculators for each element of their financial position – for now and the future.

You or your clients enter their Starting Financial Position, including personal cash flow, assets and liabilities, directly or via a data upload. You both then have the whole current story – shown in the instantly produced Starting Position report – as a foundation for your advice and planning.

The modelling for clients in the accumulation phase of life involves the important decision of how much of their personal income will be allocated for investing.

- For example if Bob and Sue decide to invest 10% of their annual gross income for the next 10 years, this amount is then available in the investing area of the software – for you to show what your advised usage of these funds will be. All asset types are available for inclusion, and instant reports show the projected future outcomes of the entered investing strategy.

For clients in the retirement phase of life, your modelling will focus on the drawdown and asset sales plan, over the required number of years. The required retirement income for the personal cash flow is entered, and then your advised strategies to achieve this are entered. The modelling calculations show exactly what is (and isn’t) possible, with the client’s assets, and anticipated personal spending.

PAINTING THE PICTURE

Many advisers tell us they are looking for a way to SHOW their clients the future impact of their advice. Numbers on a page often just don’t cut it with their clients. It is said that the majority of people are visual processors and Financial Mappers PRO addresses that need for pictures to tell the story.

On-screen graphs and tables are generated instantly, and any adjustment of advice outcomes can be seen immediately. Clients can now easily understand exactly where your advice could take them. This builds enthusiasm, trust, and referrals.

RICH REPORTING

Reports can be customised and a full Statement of Advice report template can also be created, which uses instantly created charts and tables from the calculated model for each client.

Showing the modelled future of your advice to your clients is like using a modern-day crystal ball.

Enjoy the same appeal as the fortune teller by using Financial Mappers Pro.

Glenis Phillips SF FIN – Designer of Financial Mappers

Disclaimer: Financial Mappers does not have an Australian Services License, does not offer financial planning advice, and does not recommend financial products.